Providing Certified ID just got easier!

At Resolution Life, we’ve simplified the process for clients to provide certified identification (ID) or update incorrectly certified ID. We are now using Cloudcheck which is a tool for verifying client identities using a valid New Zealand driver’s license or passport (identity pages).

Please note that if your client’s ID has expired, or they do not have any valid ID to provide to us, please get in touch with us and we will discuss alternative options.

When is certified ID required?

• Partial or full withdrawal of benefits

• Transfer of ownership or

• Making a claim (just to name a few).

How does your client provide this information

To process these requests, we need a photocopy of the valid ID that can be either emailed or posted into us.

We’ll also need your client’s consent to perform their identity check through Cloudcheck.

This consent can be obtained through:

• A phone call with your client

• An email sent to your client using the email address we have recorded in our system or

• For transfers of ownership, by completing the Transfer of Ownership form that is found in Find a Form.

Note: We are aware that there have been instances where emails have been sent to your clients requesting either their drivers licence numbers or passport details with minimal information or context provided with the request. We have revised the email template to ensure this issue does not occur again.

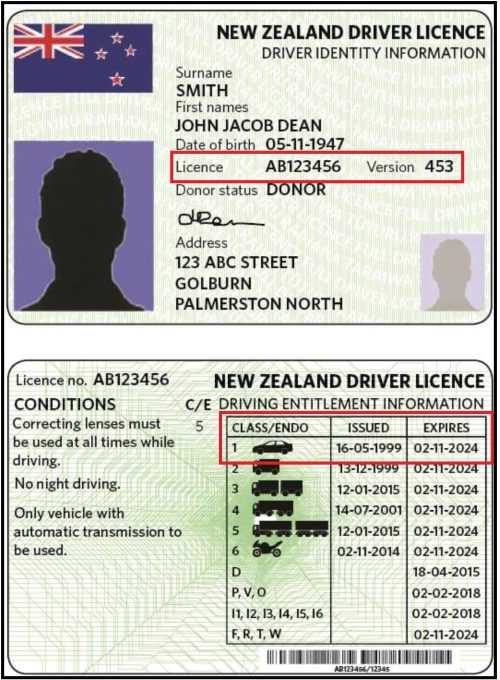

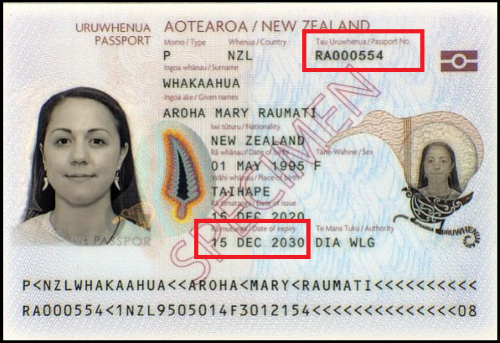

The following details will be used for verification:

• Full name

• Residential address

• Date of birth

• Driver’s licence number, version number and expiry date or

• New Zealand passport number and expiry date

Once this information is confirmed, we’ll proceed with the necessary steps to finalise the request. If Cloudcheck result returns as a ‘failed’, we will be in touch with your client to re-confirm their ID details. If the results still return as ‘failed’ we may need to request for certified ID to be posted to us.

Example of drivers licence

| Example of passport |

Increase to the interest rate on policy loans and premium arrears (overdue premium debt)

Resolution Life has recently reviewed the interest rate charged for New Zealand Conventional policy loans and premium arrears on policies.

Effective from 1 August 2024, the interest rate that applies to policy loans and premium arrears (overdue premium debts) will increase from 8.0% to 8.5% per annum.

This interest rate change reflects the current market interest rates and economic conditions.

What does this mean for your clients?

With the change in the interest rate, your client may want to consider commencing or adjusting their payments to reflect this change and can do so using the following options:

1. Speaking with their financial adviser

2. Logging into My Resolution Life and starting an online chat with us.

3. Completing the online enquiry form or

4. Contacting us via the Contact us page (and quoting their policy number).

Important: the debt on the policy will grow over time if there is no adjustment made to the repayment amount to reflect the change in interest rate or if there are no repayments to the policy loan or premium arrears (overdue premium debts). This may result in the debt reaching a level which would see the policy and the insurance benefits cease.

For more information on the policy loan and/or premium arrears (overdue premium debts), your client can refer to their 6-weekly statement.

Future interest rate changes

The interest rate charged for policy loans and premium arrears on policies is set by Resolution Life and is subject to change from time to time.

Advisers and their clients will continue to be notified of any future changes to the interest rate including the date the new interest rate takes effect.

Performance report now available for investment unit-linked products

A performance report for our NZ investment unit-linked products is now available on the website.

The performance report contains past performance return details for each investment option. Note that past performance should not be taken as an indication of future performance.

To view the performance report, click here.

The investment unit-linked products in the performance report are:

· Flexipol Locked-In Plan (FASUP)

· Flexipol Plan (FAORD)

· Goldline Investment and Protection Plan (ZIPP)

· Goldline Locked-In Personal Plan (ZPSPL)

· Goldline Locked-In Plan (ZPSL)

· Goldline Original Investment and Protection Plan (ZSPP)

· Goldline Original Personal Plan (ZPSPO)

· Goldline Personal Plan (ZPSP)

· Goldline Premier Plan (ZPPSP)

· Investment Linked Insurance Bond (ULAN)

· Investment Linked Plan (ULJ)

· Investment Linked Regular Premium (ULR)

· Linksave (NZORDLKS)

· Linksave Plus (NZORDLKS+)

· Portfolio Plan (UL)

· Prosperity Bond

· Retirement Income Bond

· Zenith Bond

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.