Generating quotes online

Last month, we introduced a new feature in our Premium Calculation tool, which allows you to produce or submit a quote digitally for existing customers who already have a Risk Protection Plan (RPP).

This feature streamlines the process, enabling you to generate quotes quickly and conveniently.

This month, we would like to compare the benefits of the Premium Calculation Tool and the EasyQuote software.

The Premium Calculation Tool is a quick and easy way to provide an accurate estimate of your customer’s premium amount. The benefit of the tool is the ability to search for the customer either by their name or their policy/contract number. Once the customer is located, their information is prepopulated into the tool.

The tool takes into account various factors, including age, health condition, and desired coverage. Other features of the tool are:

- Provide you with an immediate quote for the new premium based on the decrease the customer would like to make to their sum insured.

- For Income Protection you can change the waiting and benefit period.

- The quote is saved in the tool for 30 days, making it easier to go back and retrieve.

- For policies that have a renewal date within the next 2 months2 from the quote date, the tool is also able to provide what the premium will be at the policy anniversary date, as well as any projected inflation adjustments (as applicable).

- A breakdown of the current and new premium

- A 10-year projection for the new premium1

1 Feature currently not available for policies renewing within the next 2 months from the quotation date.

2 Policy renewal (anniversary) date within the next 2 months from the quotation date

The EasyQuote software is another option for insurance quotes and allows you to obtain a quote for a new policy or an alteration to an existing policy. The process to obtain the quote is not as efficient as the Premium Calculation Tool, as all of the customer’s details need to be entered manually.

EasyQuote provides a user-friendly platform to generate personalised quotes tailored to your clients’ specific needs. By inputting relevant information such as age, coverage amount, and desired policy duration, you can access quotes yourself. (Note that the EasyQuote software can also be used to generate quotes on other products.)

Just a reminder, that if your version of EasyQuote expired on the 30th of June 2023, please use the link below to update to the latest version:

My Resolution Life updates

We are pleased to announce that the My Resolution Life portal has been enhanced over the last 6 weeks with a range of new features.

These include:

- Fixed portal link from the public website

- Adviser registration issue resolved

- Improved customer name search feature

- Delivery status for Overdue Notices

- Updates to the Statements and Correspondence tab

- Ability to view closed policies

- Updated Correspondence Type

- Insurance benefits for Talisman Products

- Updated Service request view

- Adviser name and sale ID’s both showing in the portal and

- A new link to the right side of the portal dashboard for the Adviser Connect Newsletter.

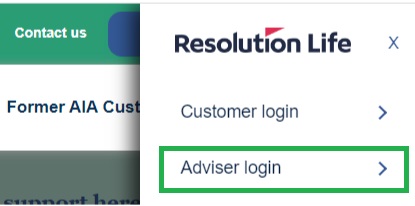

Portal link has been fixed

We are pleased to inform you that, following your feedback, we have resolved the issue with the My Resolution Life portal link from the public website. This means that when you click on the link, you will now be directed to the Adviser/Licensee Login page, instead of the Customer Login page.

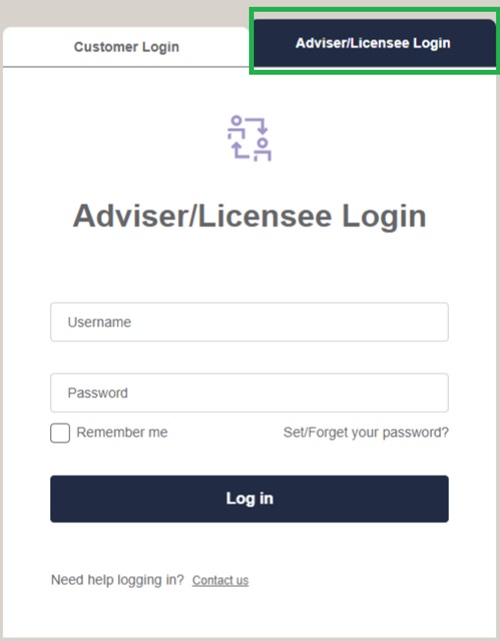

Adviser portal registrations

If you are still having difficulties with registering to the Adviser portal, the following steps may be of assistance.

1. Navigate to the Adviser login tab

2. Click ‘Set/Forget your password?’

3. Enter your username

4. Follow the instructions and change your password

5. Click ‘Update’

6. A pop up will appear advising that ‘Your password has been reset successfully’.

Customer’s name search

The my Resolution Life portal now offers you the ability to search for their records using either their first name, last name, or an exact match by using their first and last name or their date of birth.

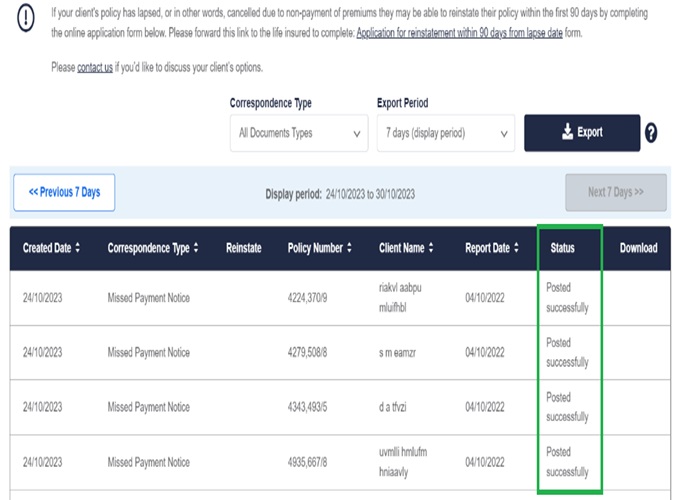

Overdue Notice display updated

The Overdue Notice display has been updated, making it easier to check the delivery status of the customer’s notice. i.e. to confirm if the notice was successfully delivered to the customer. If the delivery status is unsuccessful then the customer has not received the notice and needs to be made aware that they have an outstanding payment and their address details needs to be updated.

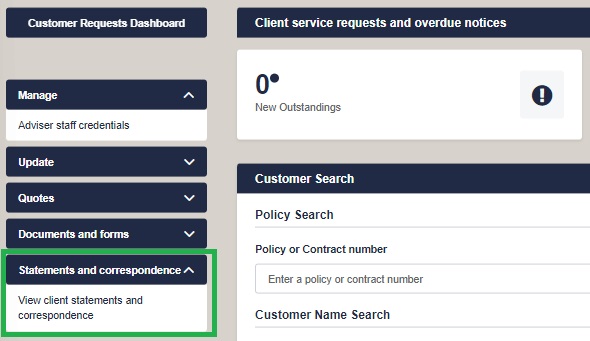

Statements and Correspondence tab

Ability to view closed policies

You now have the ability to view closed policies, without having to go into a specific customer profile in the Adviser Portal. This enhancement to self service capabilities is accessible from the main dashboard, in the left side menu titled ‘Statements and Correspondence’. Here, you can retrieve documents for a single policy, including for closed policies. Note: the adviser needs to manually enter the policy number.

Updated Correspondence Type

We have recently updated the correspondence type tab to include the naming convention of Income Tax statements. This should make it easier to identify and download the relevant document when required.

.png)

Insurance benefits for Talisman Products

Talisman Products now have the correct full insured benefit displayed on the My Resolution Life portal. If you have any questions or concerns regarding this, please don't hesitate to reach out to us.

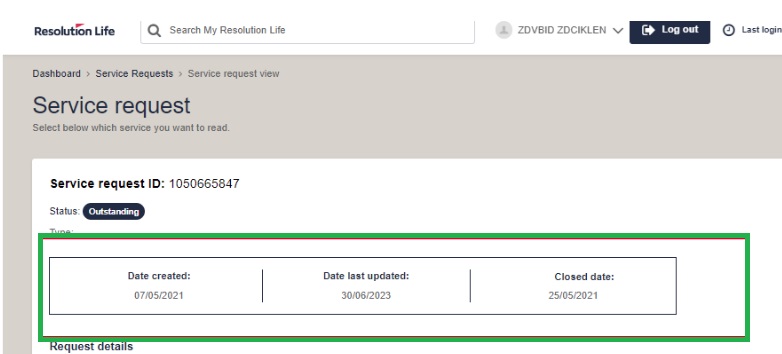

Service request view updated

We have removed the Estimated completion date from the Service request, as these dates were not accurate.

This is the new view:

Adviser names now showing

We are pleased to announce that the adviser portal now displays both your adviser sales ID and your name. This provides a more user-friendly experience for you and allows you and your staff to easily identify adviser jobs when logging in.

New Adviser Connect Newsletter link

To make it easier for you to stay up to date on the latest news and business updates, we have added a link to the Adviser Connect homepage on the right-hand side of the portal dashboard. This link provides direct access to past newsletters, allowing you to quickly and easily catch up on the latest news and business updates. You can use this link to stay up to date on the most recent information.

Consumer Price Index (CPI) Rate for 2024

Each year, Resolution Life NZ sets the CPI rate for indexation (where applicable) of current claims, sums insured on risk benefits, and policy fees. The CPI rate used is the annual inflation rate as of 30 September, applied to policies for the following calendar year.

The new rate to apply from 1 January 2024 to 31 December 2024 is 5.6%.

Please note:

- As per policy terms, some ex NMLA policies would normally have a 3% minimum increase applied. However, this will not apply in 2024 as the actual rate of 5.6% exceeds this.

The CPI rate for 2024 continues to be higher in recent years than historic averages, so you may receive customer queries about its impact on premiums. As per the policy terms, customers can decline individual CPI increases or modify the sum insured to a lower level, if they desire.

It’s also important to note that other factors, such as age and general premium rate changes (if applicable), will impact premiums.

For more information about the Statistics NZ CPI release, refer to their website

Licensee settlement dates

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.