Renewal and Overdue notices weekly email

Since April, we’ve been sending regular weekly emails advising you of clients who have missed payments, and are at risk of lapsing or who have lapsed.

From early 2025, you’ll receive:

• an updated email that includes:

o a summary table showing the number of missed payment, pre-lapse and lapse notifications sent to customers and the value of annual premium at risk

o the number of customers that received Renewal notifications.

• this email is only sent if one or more of your clients received one of the relevant notifications that week.

New optimised email sample (98 kB)

We’re committed to supporting you and your clients with products and services that meet your needs. You can

• Learn more about the existing report

• Read more on flexible policy and payment options

• Make payments online.

If you have any issues with this email or report, or want to discuss client payment options, please chat with us online or contact your adviser support team.

Supporting clients with a call ahead of their policy renewal

We’re focused on improving how we support you and our joint customers. From late January 2025, we’ll start calling some customers ahead of their insurance policy renewal.

Our Customer Solutions team in New Zealand will proactively engage with customers to:

• Advise their upcoming insurance policy renewal date

• Remind them of the advice they can access from their adviser

• Reiterate the value of their insurance and

• Ensure they are supported through their renewal.

We're also aware that across the industry, many customers are cancelling their cover for various reasons. So, by making an extra customer call, we’ll highlight that their policy is flexible and encourage them to contact their adviser to explore their options. We hope customers that want to remain insured can keep their cover, and in turn reduce industry lapse rates.

Who will be contacted?

We’ll attempt to call some customers with Lifetrack and Risk Protection Plan policies within the 40 days before their policy renewal date.

We’re here to help

We’re committed to supporting you and your clients with products and services that meet your needs.

Your clients can also access information on:

• Reviewing their insurance

• Affordability options

• Making payments online.

If you have any issues with these calls, or want to discuss client payment options, please chat with us online or contact your adviser support team.

New Zealand service standards update

We're committed to empowering and supporting our advisers. Over the past year, Resolution Life has made significant progress in improving service standards. By streamlining processes and investing in new technology, we've achieved faster response times and more efficient operations.

We're proud of this progress and remain committed to delivering exceptional support. To demonstrate our transparency, we've outlined our key performance indicators and the improvements we've achieved over the past year.

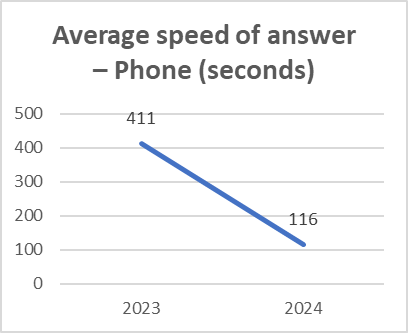

Average speed of answer - Phone

We've reduced wait times 295 seconds (nearly 5 minutes). This means you can get the help you need faster, so you can get back to what matters most.

Average speed of answer – Online Chat

We've also significantly improved our online chat service, reducing wait times by 69%. This achievement was made possible through strategic investments in technology and the expansion of our dedicated support teams.

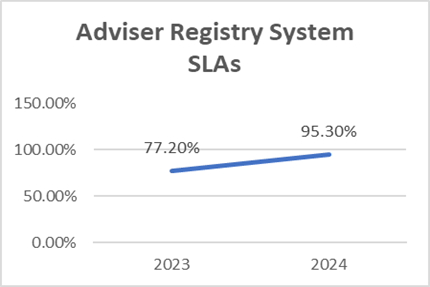

Adviser Registry System

We've successfully cleared any backlogs associated with customer transfers and are now processing 95.3% of all tickets within the SLA, a 23.4% improvement.

Administration Processing SLA’s

We've also focused on improving our administration processes. By allocating additional resources, and investing in our team members skills and training. We've significantly outperformed our 2024 targets; we’ve processed 93.7% of financial transactions within SLA. This is 8.7% above the target of 85%. This all means faster turnaround times and improved efficiency for your business.

| Year | Financial transactions |

| 2023 | 84.0% Financials (3 days) |

| 2024 | 87.5% Financials (3 days) |

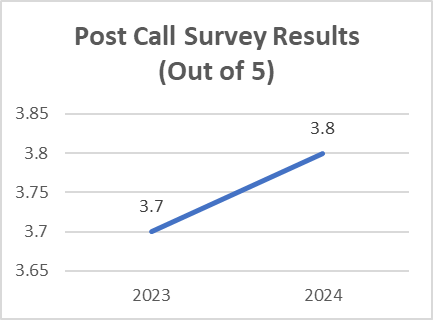

Post call survey results

This commitment to service is reflected in our improved call survey results. We're pleased to see increased engagement from our advisers in our feedback surveys. Your feedback is invaluable in helping us shape the future of our business.

Important Information: Elevate Renewal Notices

Resolution Life has identified that between 26th September and 30th October, 2024, a number of renewal notices were issued to customers in Australia and New Zealand, containing an amount which had been adjusted for inflation incorrectly.

Customers who received a renewal premium ‘without inflation’ were affected by this issue. To resolve this, we have sent impacted customers a notification addressing the inaccuracy. This letter will clarify that a recent inflation adjustment notice contained an inaccuracy in the calculated ‘without inflation’ premium. Renewal notices are sent to customers 60 days prior to any new premium being deducted. Customers who wish to know the accurate ‘without inflation’ premium can contact us directly. Attached is a sample communication sent to affected customers

Sample Elevate Renewal Letter (83 kB)

Please note customers who have received a ‘with inflation’ premium is correct. No action is required for customers who wish to proceed with the inflation adjustment.

Resolution Life New Zealand Christmas and New Year operating hours

As the holiday season approaches, we want to ensure a smooth experience for our advisers during this busy time. With many businesses adjusting their operating hours during the holiday period, we wanted to let you know ours, so that you can plan ahead.

At Resolution Life, we're committed to providing advisers with the support they need. Our contact centre, administration teams and click-to-chat service will be open during the holidays, as outlined below:

Dates

23rd Dec – 9am – 3pm (NZDT)

24th Dec – 9am – 3pm (NZDT)

25th Dec – Closed – Christmas

26th Dec – Closed – Boxing Day

27th Dec – Closed

30th Dec – 9am – 5pm (NZDT)

31st Dec – 9am – 3pm (NZDT)

1st Jan – Closed – New Years Day

2nd Jan – Closed

3rd Jan – 9am – 5pm (NZDT)

Note: some of our additional support initiatives to help customers manage their insurance policies will be paused between 20 December 2024 and will recommence from 6 January 2025.

You can self-serve and view your policy/plan information online. Just login to My Resolution Life Portal.

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.