We’re working hard to improve our service

At Resolution Life we know that our service standards aren’t what we want them to be. We appreciate your patience as we continue to invest in our systems and people to sustainably improve our service to you and your clients. We expect to continue to progressively improve each week through the actions we are taking and expect to be delivering consistently by the end of August.

We are absolutely committed to working in partnership with you to retain our joint customers.

In this month's article, we'll look at our operations backlog, call centre and registry management.

Operations

In terms of our operational back log, at the end of March 2023 we had around 3,000 hours of overdue work (backlog) across all work queues which had accumulated due to a range of separation challenges and system fixes. By early May 2023, this amount had reduced by over 30% and there remains a sharp focus on clearing this by the end of July. We have seen SLA processing time return to near target levels of 85% within 3 days (financial) and 5 days (non-financial) and we continue to increase resourcing to achieve this outcome consistently throughout Q3 and beyond.

Call centre

As noted in the April newsletter, we have recently reorganised our call centre engagement specialists into tiers based on call type and complexity in order to better leverage team experience and increase the speed of our onboarding processes. This change has started to show results with our 'Simple enquiries' now achieving an average speed of answer (ASA) of 269 seconds. This is 50% of our callers. However we know that our ‘Complex Insurance’ wait times are significantly higher and unacceptable. Whilst we still have a way to go, we are seeing the change is working and the new recruits that have joined have been making an impact. We’re continuing to hire more staff into the call centre across Australia and New Zealand, with 10 additional staff joining in May and another group joining in June.

Registry management

We know the backlog in our register management team is causing frustration. Additional resources have been assigned to the registry management team whilst we are implementing systems upgrades to be able to more easily process bulk transfers. We’ll provide further updates in our next newsletter.

We’re committed to providing a quality service to our advisers and customers – and everyone at Resolution Life is dedicated to this cause. We look forward to continuing to work with you and sharing our progress.

Adviser Accreditation – Action Required

We operate a system known as Accreditation, which sets minimum standards and expectations for any person who earns Remuneration in relation to a Resolution Life Product. A person who demonstrates that they meet the required minimum level of skill, knowledge and training is said to be accredited for that Resolution Life Product. These minimum standards reflect the expectations of the Regulator that Advisers have the appropriate level of skill, knowledge and training to provide Advice on a specific Product. Our Accreditation system helps support Advisers to attain, and maintain, an appropriate level of knowledge and skill in relevant Resolution Life Products so that our mutual customers experience great service and outcomes for themselves.

All Advisers must be accredited for the Resolution Life Products they manage or advise on. Most Advisers have completed and are up-to-date with their Accreditation, but there are some with training that remains outstanding. Resolution Life is offering Advisers until 30 November 2023 to complete their Accreditation. Any Advisers with outstanding Accreditation after this date will not be able to earn Remuneration from Resolution Life until such time they have completed their required training.

Below are instructions on how to access the portal to see what accreditation modules are outstanding. As the deadline of 30 November 2023 approaches, individual reminders will be sent to businesses who still have outstanding Accreditations.

Portal Instructions

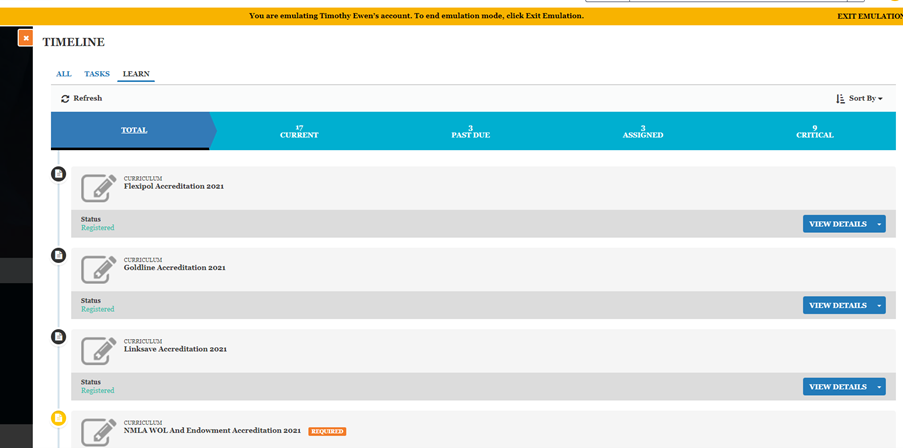

Once you have logged into the Learning Portal and click your Timeline (which can be found in the upper left of the screen, resembling a bulleted list), this is the view of your outstanding modules to be completed:

If you have not logged into the Learning Portal before, please follow the steps below:

1. Click here to navigate to the Learning Portal.

2. Enter User Name as your email address.

3. Select forgot password to reset password.

If you have any queries on this matter, please contact lifeadviseroperations@resolutionlife.co.nz.

My Resolution Life customer menu updates to make finding information easier

We’re always looking for ways to improve the customer experience with My Resolution Life, so we’ve recently made updates to the navigation menu of the My Resolution Life portal for customers.

We’ve heard feedback from customers that the original navigation menu was difficult to navigate, so we’ve simplified it and made it more intuitive. The new navigation menu should make it easier for customers to find the information they need in the portal.

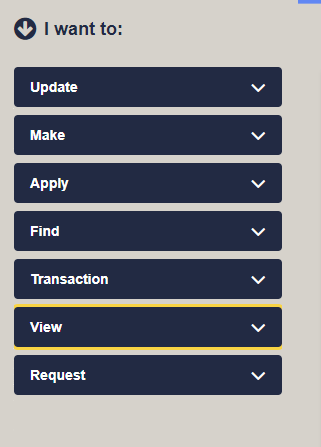

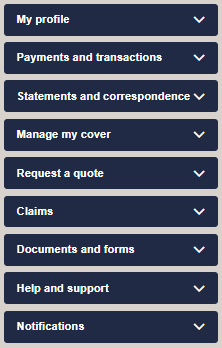

| Our old menu for customers | Our new menu for customers |

|---|---|

|

|

You’ll see this new menu whenever you’re in Customer view in My Resolution Life. For information on how to access Customer view in My Resolution Life (which shows you what the customer can see when they log in to My Resolution Life), see the My Resolution Life help centre.

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.