Investment market performance Q3 2025

As we navigate the complexities of the financial landscape, it’s important to stay informed about how investment markets are performing. The third quarter of 2025 (July 1 – September 30) presented both challenges and opportunities for investors. In this article, we take a closer look at how investment markets performed over the quarter, and we highlight some of the key economic factors from across the world that influenced these outcomes.

Australia

Share market: The Solactive Australia 200 Index, which represents Australia’s top 200 companies, was up +4.7% over the quarter. Positive returns were largely due to strong performance in the mining sector, led by BHP Group Ltd, followed by strong performance in the banking sector.

Interest rates: Australia’s inflation rate remained within the Reserve Bank of Australia’s (RBA) target range at 2.1% in Q2, down from 2.4% in Q1 2025. Core inflation, which excludes volatile items like food and energy, slowed from 2.9% in Q1 to 2.7% in Q2 2025. The RBA reduced the cash rate from 3.85% to 3.60% during the quarter but kept the rate on hold in September, as markets had expected. Markets view another cut this year as unlikely.

Housing market: The Australian housing market, as measured by CoreLogic's Home Value Index (HVI), recorded an increase of +1.4% in Q2 2025, following a +0.9% increase in Q1 2025. The increase was attributed to falling interest rates, which have acted as a catalyst for renewed momentum.

Australian dollar: The Australian dollar (AUD) continued to recover against the US Dollar (USD) over the quarter, rising 1.1% from 65.7 to 66.1 cents. The continued recovery is due to factors such as a softer USD, caused by expectations of modest interest rate cuts in the US, along with stronger economic data that reduces the chance of further interest rate cuts in Australia.

New Zealand

Share market: The Solactive New Zealand Top 50 Index saw a +5.9% rise in Q3 2025, with the positive return due to strong performance in key infrastructure and food production companies.

Housing market: The QV House Price Index showed a -0.8% drop in house prices nationally in the three months to the end of August 2025. That is 0.2% higher than the same time in 2024 and is 13.4% below the market peak in January 2022. The average property value nationally is now NZ$906,977.

Interest rates: The official cash rate was reduced from 3.25% to 3.00% during Q3 2025, with the market expecting a further reduction to at least 2.75% by the end of 2025. New Zealand’s economy, which exited recession in Q4 2024 as the economy began to grow again, saw a contraction in Q2 2025 of -0.9%, which was a lot worse than markets had expected. Inflation was 2.7% in Q2 2025, slightly higher than the 2.5% recorded in Q1 2025.

United States

Share market: US stocks had a strong quarter, supported by a strong earnings season. With the effect of tariffs on inflation less than feared, a Federal Reserve rate cut also supported US stocks.

Interest rates: The Federal Reserve cut interest rates from 4.5% to 4.25% in Q3 2025. This is in line with their goals of achieving maximum employment and price stability. The Personal Consumption Expenditures (PCE) inflation rate stood at +2.7% at the end of August 2025, while core inflation had eased to +3.1%.

Global trade and geopolitical uncertainty

As trade tensions eased, Q3 2025 saw positive returns across financial markets, with technology giants again seeing large gains as optimism around AI continued. Bond markets also saw positive returns, despite the market focussing more on the sustainability of government’s fiscal spending plans.

We continue to monitor the major drivers of markets and their impact on Resolution Life Australasian portfolios. While investing always involves managing uncertainty, the current environment is mired in elevated uncertainty. The best form of defence for portfolios is to continue to be well diversified, with exposure to a range of asset classes that can help during volatile times.

Sources:

1. Solactive Australia 200 Index Performance - Solactive

2. Solactive New Zealand Top 50 Index Performance – Solactive

3. Reserve Bank of Australia Monetary Policy - RBA

4. Reserve Bank of New Zealand Official Cash Rate - RBNZ

5. Australian House Prices – CoreLogic Home Value Index

6. NZ house Prices – QV House Price Index

7. FactSet

8. U.S. Bureau of Labour Statistics

9. Trading Economics

Annual Adviser Business Attestation

On 29 June 2022, the NZ Government passed the Financial Markets Conduct of Financial Institutions Amendment Act (CoFI), introducing a new legislative framework for regulating the conduct of financial institutions. The focus of this is protecting customers and promoting good outcomes for them. These requirements and their impact on financial advisers came into force on 31 March 2025.

To comply with these obligations under Subpart 6A of the Financial Markets Conduct Act 2013, we’re introducing an Annual Attestation for those that have a Distributor Agreement with Resolution Life Services NZ Limited (RLSNZ).

The attestation is a short seven question online form that seeks confirmation that the entity:

- Is compliant with your RLSNZ Distributor Agreement (DA), including all relevant laws defined by the DA and any relevant code of professional conduct,

- Holds and maintains current registrations and authorisations required by Law and is compliant with the terms and conditions of all registrations and authorisations held or required by Law and held by you.

An email will be sent to Adviser Businesses to complete their Attestation. If you’re a Financial Adviser who is part of a Financial Advice Business that has a RLSNZ Distribution Agreement, you will not be required to complete your own attestation, the business will submit only one attestation that confirms the compliance across for the business.

If your business identifies any areas of non-compliance within the form or anticipates needing additional time to complete beyond the due date, we kindly ask that you notify us as soon as possible.

Please complete the attestation by 30th November 2025.

If you require assistance, please contact the Adviser Register team at: lifeadviseroperations@resolutionlife.co.nz.

Update to the Administration Act - New $40,000 Threshold for Estates

Change to Estate Threshold under S65 of the Administration Act

From 24 September 2025, a long-awaited and significant change to the Administration Act 1969 will come into force, directly impacting how we handle claims and policy transfers from deceased estates.

The Administration (Prescribed Amounts) Amendment Regulations 2025 has increased the threshold for which financial institutions, including Resolution Life, can release funds without requiring probate or letters of administration. This threshold has been raised from $15,000 to $40,000. This will allow us to pay out benefits or transfer ownership of policies with a surrender value of up to $40,000 without requiring probate or letters of administration.

This is a welcome development. The previous $15,000 threshold has long been a source of frustration for customers and advisers alike, often causing delays during an already difficult time. This change will streamline the process in many cases, enabling us to pay claims quickly and more efficiently.

Key points for advisers:

- New change is active: The new $40,000 threshold applies to all claims or requests for ownership transfer made to Resolution Life from 24 September 2025.

- Our process: While the threshold amount has increased, our processes around claims and transfer of ownership remain unchanged.

- Probate may still be required: Advisers should be aware that even with the new threshold, there are still exceptional circumstances where probate or letters of administration may be necessary, for example, when there is a dispute between executors or beneficiaries of the estate. We will assess these on a case-by-case basis.

This change is a positive step in improving the customer experience during the claims process. We’re confident it will reduce delays and alleviate some of the stress on families dealing with a loved one’s estate.

For more information, a link to the new regulation can be found here: Administration (Prescribed Amounts) Amendment Regulations 2025

If you have any questions, please do not hesitate to contact us on 0800 808 267 or askus@resolutionlife.co.nz.

Less paperwork: Simplifying the withdrawal process for NZ advisers

We’re pleased to announce a simplification to the withdrawal process for New Zealand advisers and their clients with Resolution Life, aimed at making things easier and more efficient.

Going forward, if you’re the registered adviser on a client policy, you can now submit withdrawal requests by simply emailing Resolution Life the completed withdrawal application form, along with a copy of the customer’s valid ID. Importantly, the ID no longer needs to be certified - we’ll accept that as the registered adviser, you have already completed the necessary KYC checks prior to initiating the transaction. This change is designed to reduce the administrative burden, streamline processing times, and support a smoother experience for both advisers and customers.

We appreciate your continued partnership and look forward to delivering more enhancements that make it easier for you to do business and deliver value to your clients.

Introducing multi-factor authentication (MFA) for adviser logins

We're pleased to announce a new security enhancement for the My Resolution Life portal. We've introduced multi-factor authentication (MFA) for all adviser logins, to provide an extra layer of protection for your clients' confidential information.

In today's digital world, protecting sensitive information requires a layered approach. By adding MFA, we're creating a powerful barrier against unauthorised access. This simple extra step ensures that even if your password were to be compromised, your account remains secure, providing essential peace of mind for you and your clients.

What to expect

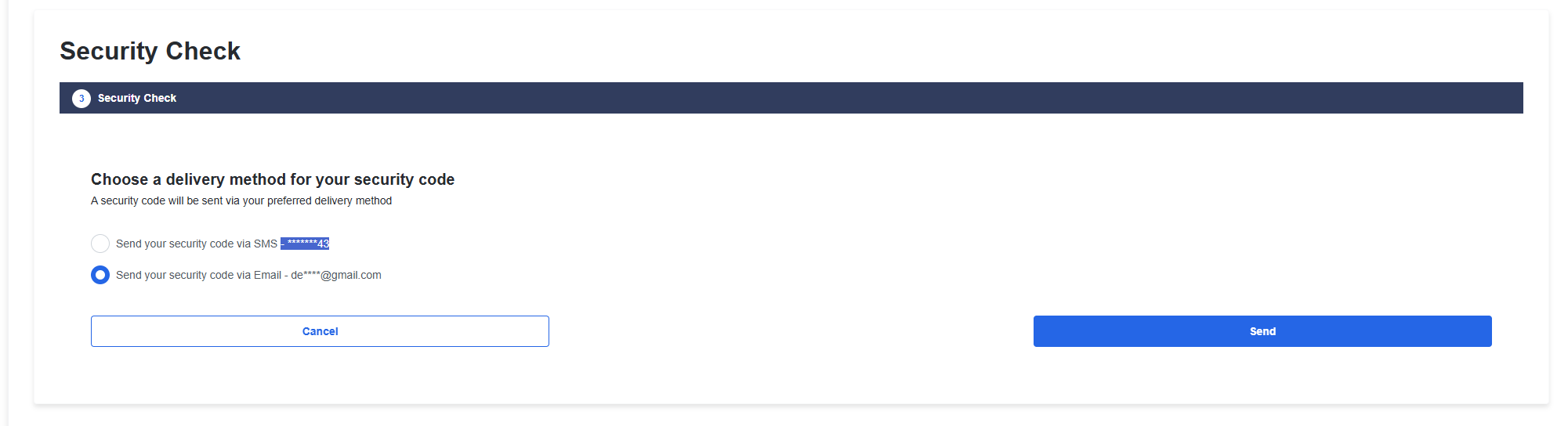

The next time you log in to the My Resolution Life portal, you'll be prompted to select your preferred channel (SMS or email) to receive a one-time security code. You'll then need to enter that code to complete your login.

This new process is quick and easy, ensuring your information stays protected with minimal disruption to your workflow. Each time you sign in to the portal moving forward, this additional step will be a required part of your login process.

This is a key step forward in our shared commitment to protecting client data and maintaining the highest standards of security. By working together, we can ensure the My Resolution Life portal remains a safe and trusted platform for your business. We appreciate your partnership in making this transition as smooth as possible. For any questions or support, please contact us at 0800 808 267 or lifeadviseroperations@resolutionlife.co.nz.

Osara Health recognised by TIME as a top global Health-tech company

Osara Health, one of Resolution Life’s trusted support providers, has been named amongst TIME ’s World Top HealthTech Companies for 2025, in the telehealth & treatment category.

Osara Health’s digital cancer support services are available to eligible Resolution Life customers across Australia and New Zealand. This recognition reflects Osara’s leadership in delivering personalised, evidence-based care through digital channels -support that complements the broader wellbeing services offered by other providers on our panel.

A global leader in specialised cancer support

Osara Health’s flagship solution, Cancer Coach, combines specialised telehealth coaching, behavioural science and digital tools to create a structured, whole-person care model.

This specialised support assists customers with guidance on:

- Symptom management and tracking

- Emotional wellbeing and mental health support

- Nutrition and exercise tips and tools

- Preparation for returning to work and daily activities.

Dr. Raghav Murali Ganesh, Co-Founder and CEO of Osara Health, said: "Being recognised by TIME as one of the world's leading HealthTech companies is an incredible honour and a reflection of the impact our team, partners and customers are making every day. Our mission has always been to empower people with cancer to live fuller lives, and this recognition validates the importance of that mission on a global stage."*

What customers are saying

Here’s what a recent Resolution Life customer who completed the Cancer Coach program in September had to say:

“It’s helped me to recognise eating and sleeping habits—if I didn’t go through this, I wouldn’t have known this stuff. The chats have been good, as I’ve only spoken to the doctors about this before. Now I know who else I can call if I need more assistance. You were always good to keep our appointments. It wasn’t forceful conversations, just genuine caring of my needs. Five modules is good—five things you can work on. I really liked the voice of fear and voice of calm.”

Our commitment to holistic claims support

As part of Resolution Life’s commitment to holistic claims support, Osara Health is on a panel of rehabilitation and wellbeing specialists we work with, who help ensure eligible customers receive the right care at the right time, based on their needs.

The TIME accolade evidences the calibre of specialised services we make available to our customers, and underscores the value of our partnerships, which aim to deliver meaningful support and excellent health outcomes. By seamlessly integrating Osara Health into our existing offering, we’re making impacted customers feel supported and informed.

Read TIME’s full list of the World’s Top HealthTech Companies of 2025 here.

Source:

* https://osarahealth.com/blog/osara-health-named-to-times-worlds-top-healthtech-companies-of-2025/

A modern threat: staying alert to phishing and vishing

Cybercriminals are becoming increasingly bold and creative in how they target both companies and individuals. Recent high-profile breaches across airlines, other insurance companies and well-known retailers, highlight how effective modern social engineering can be.

These attacks are no longer just aimed at corporate systems. Criminals can and do also target customers directly, especially when stolen data gives them the means to personalise their approach.

How these attacks work

Today’s cyber scams often blend multiple techniques to appear convincing and to bypass security checks. Below is an overview of some of the tactics being used by scammers:

Vishing (voice phishing): Fraudsters call pretending to be company staff member, technical support, or a trusted service provider. They may used spoofed phone numbers and scripted conversations to pressure people into providing their login details, resetting passwords, or granting remote access to their account.

Phishing: Fraudsters send realistic looking emails or text messages, that appear to genuinely have come from legitimate sources such as your bank, a retailer, or even your own employer. These often contain links to fake login pages or provide urgent instructions designed to trick you into revealing your information, providing your Multifactor details, or enabling the fraudster to deliver malicious software that might spy on your activity .

Credential acquisition: By combining phone calls, fake emails and SMSs’, attackers can capture passwords, deliver fraudulent multi-factor authentication requests, or take over your accounts entirely, which can lead to identity theft.

Why this matters to you

Even if you’re not part of a targeted organisation, stolen customer data can make it much easier for criminals to craft highly believable scams. This means you could be contacted by someone who appears to know genuine details about you - making their request seem more legitimate and harder for you to identify.

How to protect yourself

• Pause before you act: Treat any unexpected call, email, or text asking for credentials or computer access as suspicious.

• Check the source: Independently verify requests by contacting the company. Use official contact details and never the ones provided in the message or call.

• Be wary of urgency: Messages or calls creating pressure to act quickly are a red flag.

• Protect your accounts: Use strong, unique passwords and enable multi-factor authentication wherever possible. Consider using a password manager (one example is Proton Pass but there are many others) to create unique passwords for each of your accounts.

• Check if your details have been exposed: Use a trusted service like haveibeenpwned.com to see if your email or passwords have appeared in recent breaches. If they have, change those passwords immediately and avoid using the same password across multiple accounts.

Your awareness and quick action are the best defence against scammers, so it’s important to be vigilant.

If something feels off, trust your instincts. It’s far safer to double-check something, than to respond in haste. Stay alert. Stay cautious. Stay safe.

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.