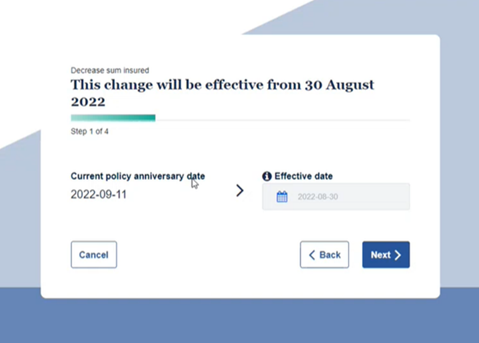

My Resolution Life portal has a new insurance premium calculator that allows you to calculate a decreased sum insured and generate a quote online.

Complete the whole process online within My Resolution Life portal – there’s no need to call us to generate a quote or raise the request. The insurance premium calculator can:

-

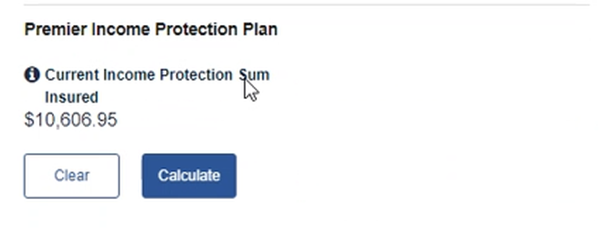

Immediately provide you a quote for the new premium amount based on the decrease the customer would like to make to their sum insured

-

Save this quote in the portal, and you can easily log back in later to retrieve it within 30 days

-

Download the quote summary

We understand that it’s been a period of economic uncertainty for everyone. This is why we have launched a new insurance premium calculator in My Resolution Life portal to allow you to quickly understand a customer’s options if they’re reviewing their life insurance policy and looking to decrease their sum insured.

Eligible products

This is available in My Resolution Life for Risk Protection Plan with primary and secondary benefits (TPD/Death/Trauma).

In the future, we’ll roll out the insurance premium calculator gradually across all products, along with other types of changes you can request to make to a policy.

How to use the insurance premium calculator

-

Login to the My Resolution Life portal

-

Search for the client

-

On the left-hand side menu, select Request, then a decrease premium calculation

-

You’ll be presented with the option to decrease sum insured

-

Follow the prompts to generate a quote.

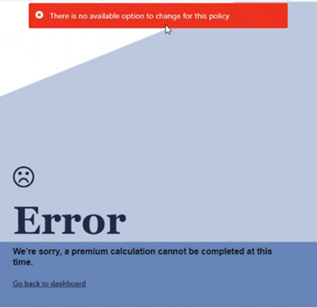

As mentioned, this is currently only available to certain policies, and our goal is to expand the functions of the insurance premium calculator. If the policy doesn’t meet the criteria, you may see the following messages.

| Message | Reason for message |

|---|---|

|

The policy is one of the following:

|

|

The decrease option for Income Protection Plan is currently disabled. Please contact us to raise a request. |

Future developments for the premium calculation tool

We know life can change at any moment, and our customer’s policies should easily and quickly adapt to suit their needs.

Our planned future releases for this insurance premium calculator will allow customers to take control of their policy and request to make a range of changes to their premium cover online, anytime. This includes the ability to decrease sum insured for income protection.

We’ll keep you updated of these future releases in this adviser newsletter.

We want to hear your feedback

We want to hear about your experience with the insurance premium calculator and if there is room for improvement on the current functions. If you have any feedback, please reach out to your Relationship Manager.

Read the October 2022 newsletter articles

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.