Improving our service during the 2nd quarter

At Resolution Life we know that our service standards have not been what we want them to be. We appreciate your patience as we continue to invest in our systems and people to improve our service to you and your clients.

We are pleased to share with you the improvements we have made in our service at Resolution Life during the 2nd quarter of 2023. As part of our ongoing commitment to delivering a quality service, we’ve made changes within our call centre and operations.

Call centre

As covered in our April newsletter, we recognised the need to optimise our call centre to handle the diverse range of enquiries and requests we receive. To achieve this, we implemented a collaborative approach by bringing together our engagement specialists based on call type and complexity. By leveraging the collective experience of our teams, we can now assign calls to the most suitable specialists. This approach not only enhances our ability to handle call and chat volumes but also ensures that calls are routed to the appropriate knowledge base. The below table outlines the average wait time across the three service tiers during the 2nd quarter, which is an improvement on the 1st quarter.

We acknowledge that the Complex Insurance tier requires further attention. To support this service tier (or queue) during the 3rd quarter, we have started to move resources from the Simpler Insurance tier to bolster the support for our more complex insurance queries. The benefit of our tiered structure enables us to speed up our onboarding processes (during the 1st half of 2023 we onboarded 30 call centre staff) and move resources to where they are needed once they are upskilled. Our major focus is on upskilling staff to bolster our complex insurance call team to reduce the wait times in that queue.

It's pleasing to see increased use of our chat functionality to gain the support you require.

2nd quarter (April to June 2023) – adviser calls and chats across Australasia

|

Service tier |

Calls |

Chats |

||

|

Call Volume |

Average wait time (minutes) |

Chat Volume |

Average wait time (minutes) |

|

|

Simple Insurance |

7,432 |

1 minute & 48 seconds |

365 |

1 minute & 54 seconds |

|

Complex Insurance |

15,270 |

27 minutes & 48 seconds |

17,219 |

10 minutes & 30 seconds |

|

Super & Investments |

3,259 |

11 minutes & 30 seconds |

1,203 |

2 minutes & 24 seconds |

Operations

In addition to making improvements to our call centre, we have also focused on streamlining our administrative processes and implementing automation to improve our speed and capacity.

Transaction Backlog

We have reduced our administration backlog by approximately 50% over the quarter and are working hard to clear the remaining backlog by the end of August 2023.

New transaction processing

Our service standards are determined by the percentage of transactions processed within the required number of days, with 3 days for financial transactions and 5 days for non-financial transactions. Whilst we are still someway short of our goal of 85% of financial transactions completed within the 3 days and 5 days for non -financial transactions, we are pleased to report that our grade of service has improved. The table below shows grade of service for the 2nd Quarter.

2nd Quarter (April to June 2023) – SLA – Transactions – across Australasia

|

Transaction type |

Insurance admin |

Super & Investments admin |

||

|

SLA* |

Transaction Volume |

SLA* |

Transaction Volume |

|

|

Financial |

76% |

6,035 |

78% |

33,822 |

|

Non-financial |

71% |

35,601 |

62% |

36,663 |

*SLA– percentage of transaction processed within days: Financial, 3 Days; Non-financial, 5 Days.

New simpler and more efficient underwriting process to benefit you and your customers

We’ve simplified the submission process for some requests that involve underwriting by removing the need to complete and return a PDF form to us. Instead, some requests can be completed through an online form or in the My Resolution Life portal.

Why are these updates happening?

We’re updating our processes so that:

-

There are minimal steps to completing the request, making it a more efficient process.

-

We’ve simplified the questions asked of customers. Additionally, where eligible customers can raise this request in My Resolution Life, their policy details will have already been pre-filled, which means even less questions to complete.

-

Customers will know immediately whether they have been accepted through the online underwriting questions once they’ve submitted their request.

-

If a customer has been unsuccessful, they will have the option to provide further information which can be considered by our underwriting team.

Below is a breakdown of the changes.

|

Request |

Who can raise this request? |

What is the new process? |

|

Exercise continuation options |

Advisers and customers |

Once an application has been submitted, customers can complete the underwriting questions through an online form via a weblink. We’ve condensed the online form to a much simpler set of questions, so it’ll now be quicker to complete. |

|

Reinstate a policy when the policy has lapsed within the past 3 months |

Customers |

If the person is both the policy owner and life insured Customers can complete this request in My Resolution Life by following these steps:

If the person is the life insured but not the policy owner Customers can also complete an online form. However, unlike the above option of completing it within My Resolution Life, customers will need to provide additional information, such as policy information. |

|

Update smoker status or occupation |

Customers |

If the person is both the policy owner and life insured Customers can complete this request in My Resolution Life by following these steps:

If the person is the life insured but not the policy owner Customers can also complete an online form. However, unlike the above option of completing it within My Resolution Life, customers will need to provide additional information, such as policy information.

For a customer to apply to change their occupation rating and proceed through the underwriting questions, they will need to be issued with a quote within 30 days that accurately reflects their current occupation. |

Please note if the customer is unable to complete the request in My Resolution Life or through the online form, they still have the option of applying via PDF forms.

The latest My Resolution Life fixes to know about – including missed payment reports

Our latest fixes in My Resolution Life means you can get information you need online to manage customers’ policies. This month, we’ve updated the:

-

Missed payment reports

-

Gross withdrawal and net withdrawal values for Whole of Life and Endowment products, and

-

Search for customers.

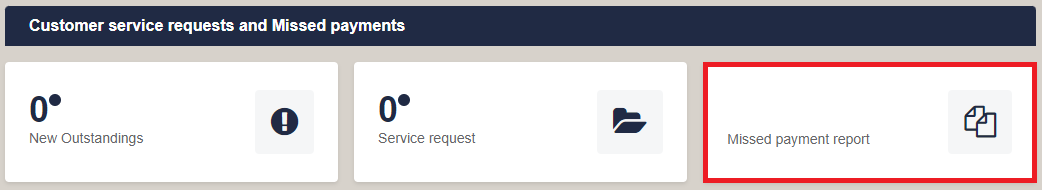

Missed payment reports

You can now learn which of your customers received a missed payment notice through My Resolution Life.

To access the missed payment report, simply login to My Resolution Life today and click on Missed payment report from your dashboard.

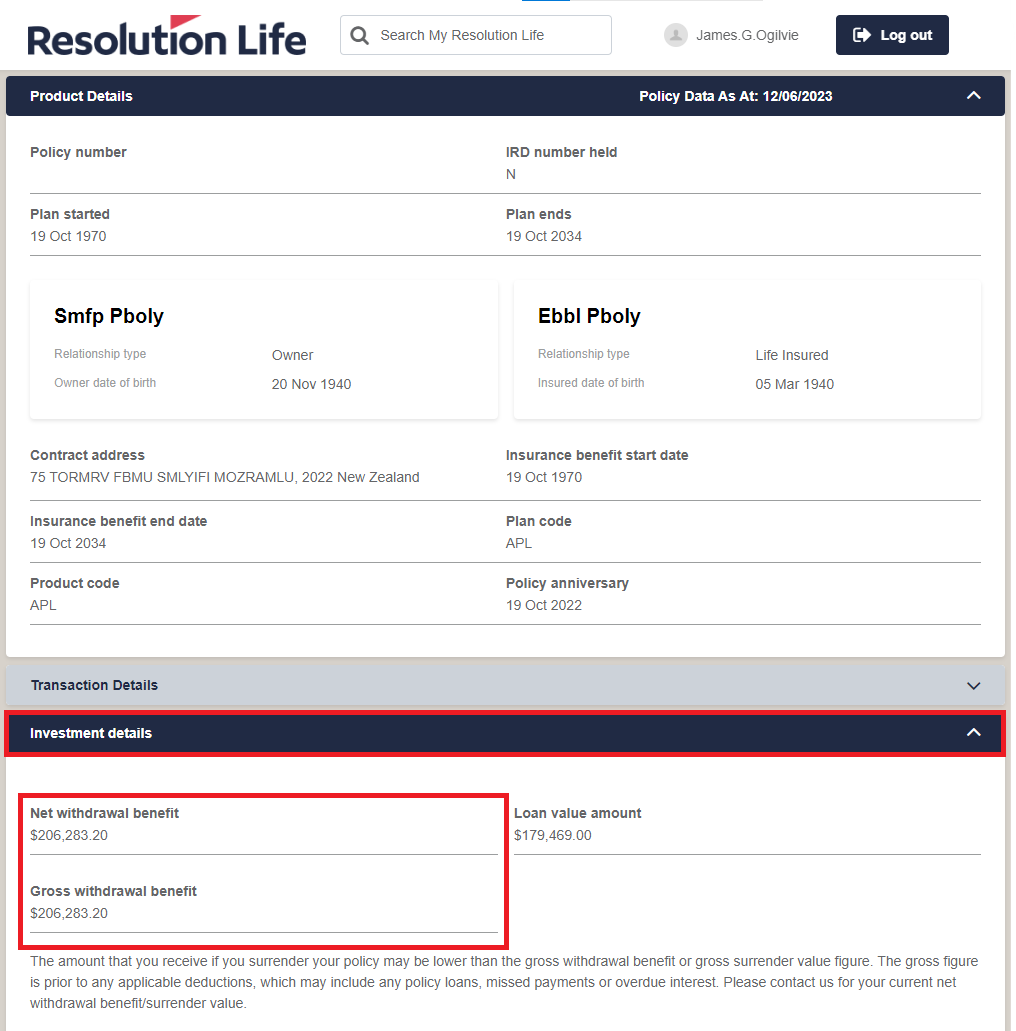

Gross withdrawal and net withdrawal values

|

Products impacted |

Audience |

What has been fixed? |

|

Adviser and customer |

You and customers can now view the gross withdrawal and net withdrawal values for Whole of Life and Endowment products. This can also be known as Gross Surrender Value (GSV) and Net Surrender Value (NSV). If you need to view these amounts, simply log in to My Resolution Life, search for your customer to enter Customer View and these amounts will appear under Investment details.

If you need help or tips on how to access Customer View, see the My Resolution Life help centre. |

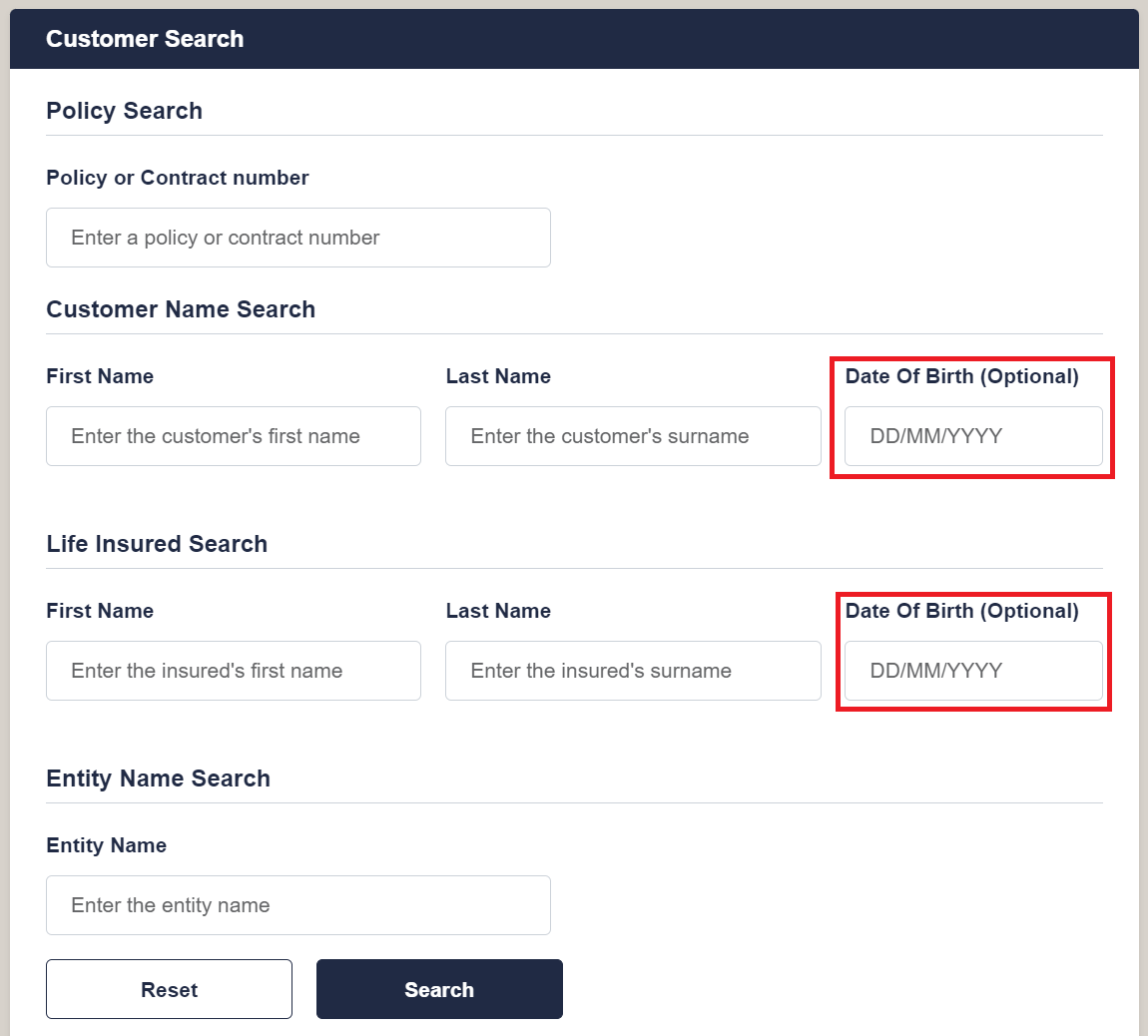

Searching with a customer’s date of birth

You now have the option of searching for customers in My Resolution Life by their date of birth.

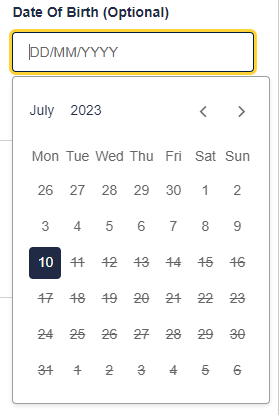

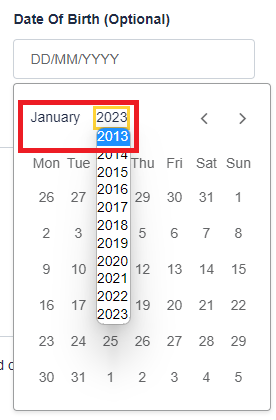

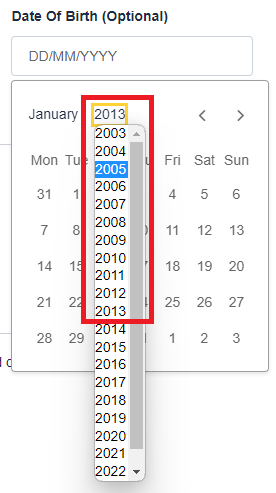

When putting in the date of birth, the below drop down appears:

On the drop down, select the year to quickly go back to a further date. The drop down initially shows the last 10 years as dates you can select. To select a date older than the past 10 years, click on the oldest available date. For example, in the below screenshot, click on 2023, then select 2013 from the drop down.

The dropdown will extend to show the past 10 years. Repeat the above steps to get to the year you want to select.

Extra payments for recently exited conventional customers

We’re contacting former conventional customers who have recently surrendered their policy to offer an additional payment. This ‘extra’ payment is for most customers who have surrendered a conventional product before it reached maturity, since 2020. This follows our March announcement of changes to increase surrender values for our Whole of life and Endowment customers in Australia and New Zealand.

We are writing to around 10,000 former customers who will be offered the extra payment. This is over and above their final payment as a gesture of good will. These letters will be sent from 31 July 2023.

There is no call to action for customers where we have their correct bank details as these payments will occur automatically in Q3 2023.

For customers where we don’t have a current bank account (or they have changed bank accounts), these customers will need to provide new bank account details via our enclosed form and reply-paid envelope which will issue with the letter. Some customers will receive an email, and they can print the form attached in the email and post it back to us. This needs to be returned by 31 August 2023.

These customers will be pointed to a dedicated website page for more details including FAQs.

Key points

-

This extra payment is an amount we are making available to our former customers. Customers may choose to opt out of the payment.

-

The extra payment amount is specific to each customer and is based on the product they were invested in.

-

This follows the change to our surrender value calculation on 22 April 2023.

-

As these are former customers, we will not be providing customer lists to advisers. For any customers who are still advised, we have suggested they contact their adviser if they require financial planning assistance.

For questions, email us at ConventionalWDV_NZ@resolutionlife.co.nz

Update to the current version of EasyQuote

If your version of EasyQuote expired on 30 June 2023, please use the link below to update to the latest version:

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.