- General Enquiries

- My Resolution Life

- Claims

- Product Information

- Managing my policy

- Update my details

- Payments and withdrawals

- Voice of Customer

I want to find a form

Please refer to our Find a form page, where you can locate various forms by clicking on the drop box.

We're here to help so if you can't find the form you are looking for or if you have any questions about your insurance

- Contact us

- Contact your financial adviser

How do I make a complaint?

At Resolution Life we are committed to helping you and doing what's right by our customers. We care about what you think and welcome your compliments, complaints and suggestions. If you are unhappy with any part of your experience, we want you to tell us. For information on how to lodge a complaint and the process, please click here.

I want to reinstate my insurance

If your policy has lapsed, or in other words, cancelled due to non-payment of premiums you may be able to reinstate your policy by completing an application for reinstatement for your product under Forms and tools > Find a form

Select your product under the dropdown 'For my product', find the form titled 'Application for Reinstatement....', complete the application and send it to us. Here are our contact details.

What is a verbal authority and how do I give it?

Verbal authorities are recorded over the phone and are kept on file. This allows Resolution Life to disclose information in accordance with life insurance regulations. A verbal authority can only be given, amended and or cancelled by the Policy Owner. To add or make changes to this authority, please contact us.

How do I add a power of attorney?

A Power of Attorney is a legal document that is arranged through a Lawyer, where you nominate a person or trustee organisation to manage your financial affairs, in case you’re unable to do so. For example if you are travelling or are suffering from a sickness. You still have control of your affairs, and you can revoke your Power of Attorney at any time.

Can I pause my premium and cover?

We understand your circumstances may change, and we welcome a conversation about your needs.

If you are experiencing financial difficulty due to COVID-19 and want to see if your premium can be paused, please click here.

All other premium pause options can be found on your policy document.

Alternatively, please contact us to discuss your options or contact your financial adviser.

Where can I send a third party authority?

Please send your third party authority to askus@resolutionlife.co.nz or to PO BOX 1692 Wellington 6140 New Zealand.

Please ensure your third party authority form is signed and dated within six months of sending and includes the following

- Policy number

- Policy owner name

- Policy owner date of birth

- Policy owner address

- Third party name

- Third party date of birth

- Third party address

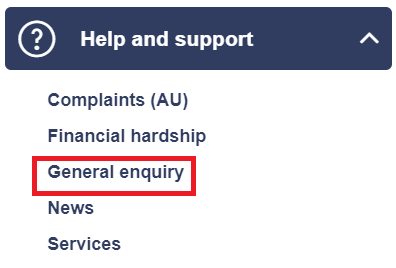

How do I raise a general enquiry?

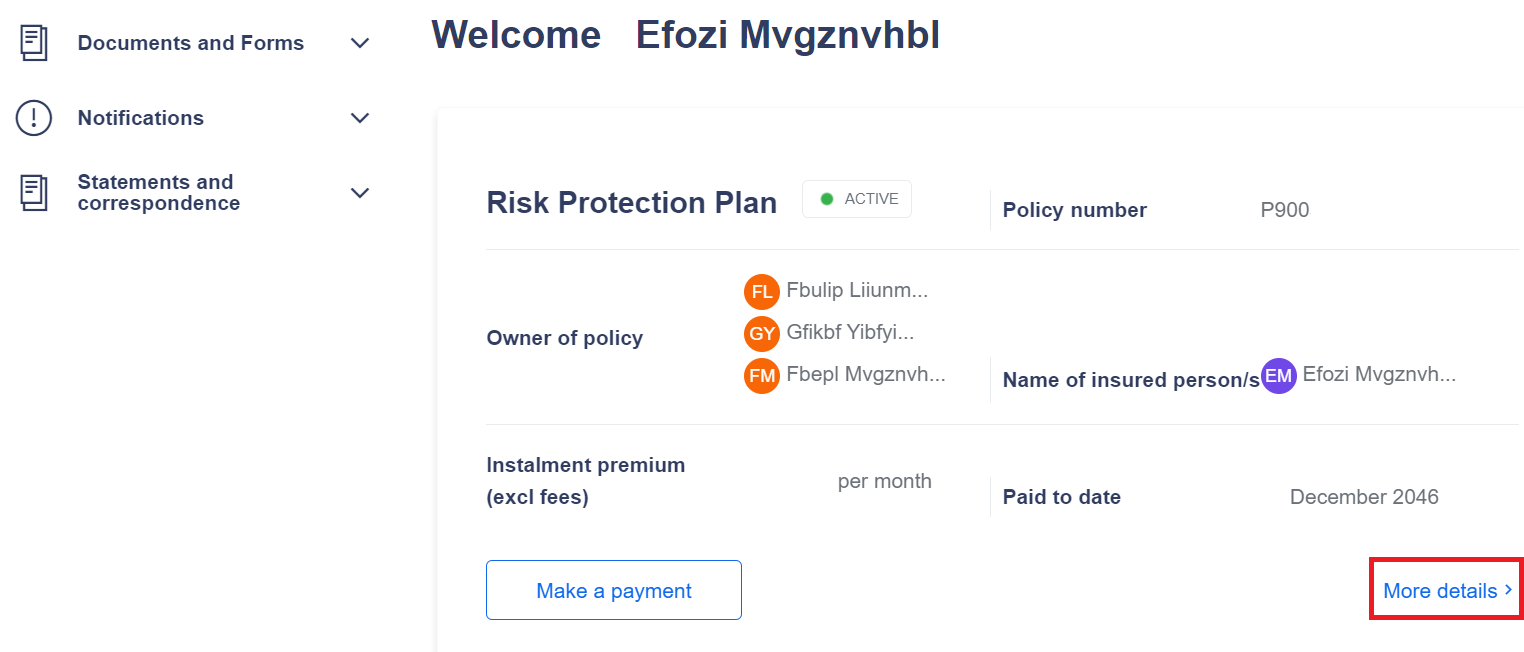

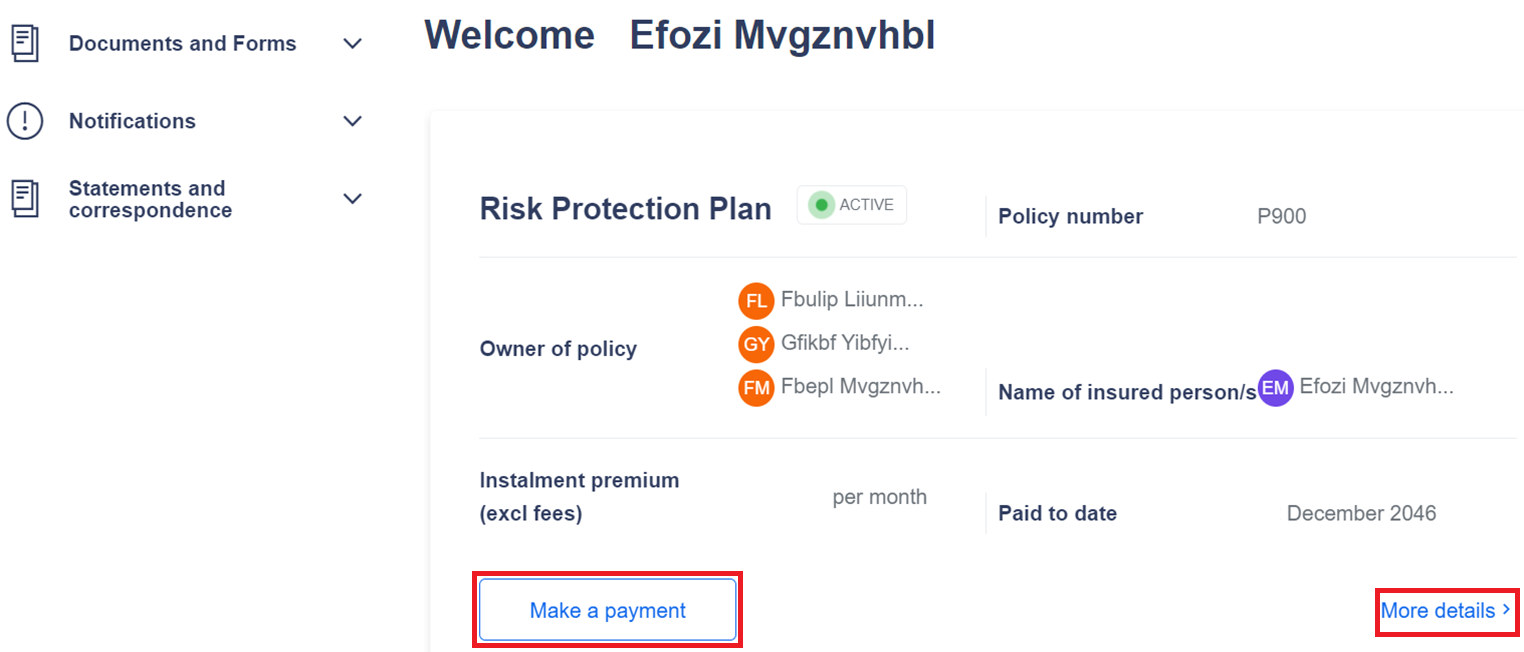

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

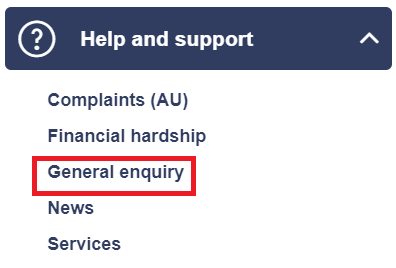

From the policy dashboard, select Help and support → General enquiry from the left-hand side.

To assist you with your enquiry, you have the option of having your personal details prefilled into the form.

Complete the form and write your enquiry in the box provided. If you have any supporting documents you want to attach, you can do this by dragging or uploading the file in the field available on the online form. Once the online form has been completed click Submit.

Your enquiry will then be submitted to Resolution Life to process, and someone will be in touch with you.

If you would like your enquiry looked at sooner chat directly with one of our consultants by clicking the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

How can I update my personal details?

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

Note: If you hold more than 1 policy with Resolution Life, you will need to update each policy individually with your updated details.

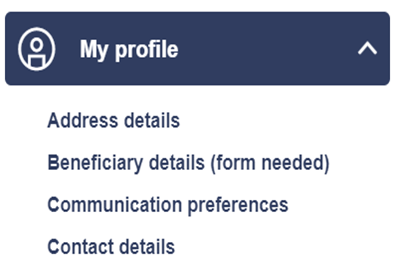

Your contact details (phone, email, address, and communication preference) can all be updated online by selecting the relevant option in the navigation menu.

From the policy dashboard, to update your personal details, select My profile from the left-hand side and select the relevant option.

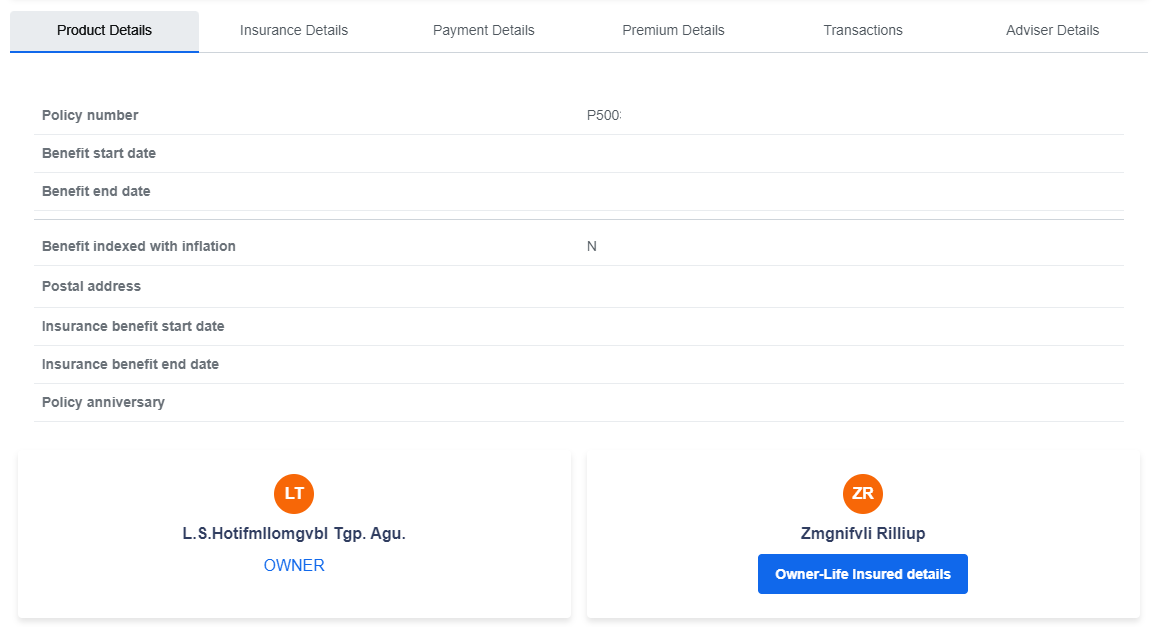

What information is displayed on my insurance policy?

After logging in, you’ll land on your dashboard (the page that displays after you log in).

The information that is displayed is a high-level review of your policy with us. It will show you the name of your product, policy number, Owner of the policy, name of insured person/s, Instalment premium and Paid to date details.

From this screen you can also Make a payment to your policy or select More details.

By selecting More details on the right-hand side of the screen, this will take you to the policy dashboard, where you will be able to view more detailed information regarding your Product details, Insurance details, Payment details, Premium Details, Transaction and Adviser Details. You are also able to view Policy owner details listed on your account.

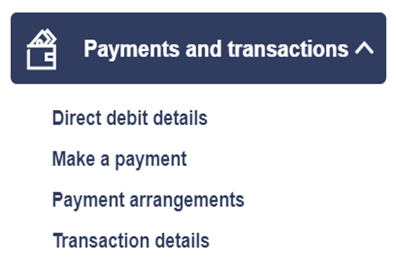

How can I change my payment details or make a payment through the Portal?

There are two ways that you can update your payment details with us, either through direct debit or by changing your payment arrangement.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

Direct debit

If you want to update or set up a direct debit, you can do this by selecting Payments and transactions → Direct debit details from the left-hand side.

Changing your payment arrangement

Any other payment related changes such as change of payment frequency or removal of a direct debit can be done by selecting Payments and transactions → Payment arrangements from the left-hand side and complete the form. Your enquiry will then be submitted to Resolution Life to process.

Making a payment

To make a one-off payment, select Make a payment from the left-hand and complete the online form. Your payment will then be submitted to Resolution Life to be processed.

If you are unsure of what payment option to use, chat directly with one of our consultants by clicking the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

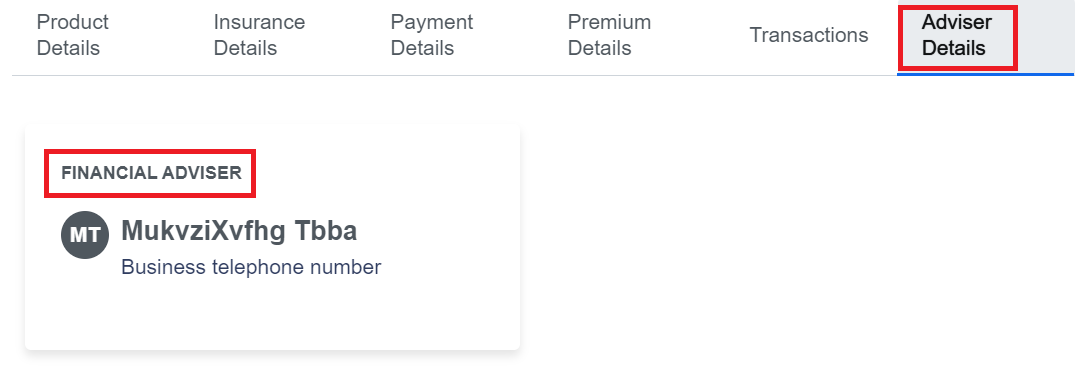

Who can I talk to about my policy?

If you can’t find what you are looking for you can speak to your financial adviser.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

You need to select the policy you are enquiring about and select More details on the right-hand side of the screen.

Once the policy details have appeared, you will click on the tab called Adviser Details for their details.

You can also submit an online enquiry to Resolution Life from the policy dashboard, by select Help and support → General enquiry from the left-hand side.

Complete the form and write your enquiry in the box provided. If you have any supporting documents, you want to attach you can do this by dragging or uploading the file in the field available on the online form. Once the online form has been completed click Submit.

Your enquiry will then be submitted to Resolution Life to process, and someone will be in touch with you.

If you would like your enquiry looked at sooner chat directly with us by clicking the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

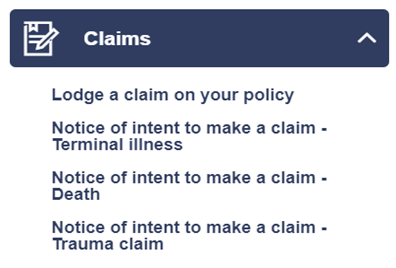

How do I make a claim?

You can start the claim process simply by completing the form online.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen underneath the policy that you are looking to make a claim on.

When the policy details appear select Claims from the left-hand side and select the type of claim.

Your claim will then be submitted to Resolution Life to review, and someone will be in touch with you.

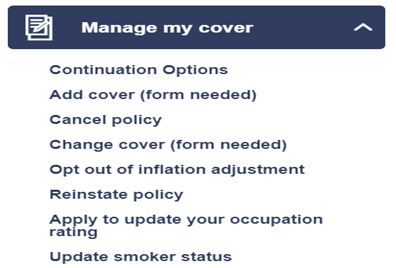

How can I alter my policy details?

Most details can be updated online.

After logging in, you’ll land on your dashboard (the page that displays after you log in).

Select More details on the right-hand side of the screen.

When the policy details appear select Manage my cover on the left-hand side and select the relevant option.

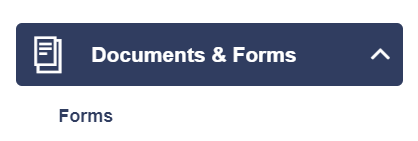

How can I find a form?

After logging in, you’ll land on your dashboard (the page that displays after you log in).

You can find a form by selecting More details on your policy details on the right-hand side of the screen.

From the policy dashboard select Documents and forms → Forms from the left-hand side.

Alternatively, you can select Help and support → General enquiry from the navigation menu and complete the form. Your enquiry will then be submitted to Resolution Life to process, and someone will be in touch with you.

You can also skip the wait by chatting directly with one of our consultants. Please click the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

When will my request be completed?

Once Resolution Life has received all the relevant information and required documents your request will be reviewed within 5 to 7 business days. If your request cannot be finalised for any reason someone will be in touch with you.

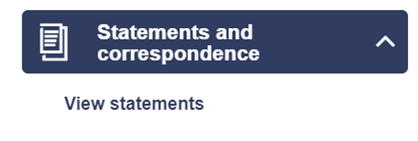

How can I see my statements and correspondence?

After logging in, you’ll land on your dashboard (the page that displays after you log in).

You can view your statements and correspondence by selecting More details on your policy details on the right-hand side of the screen.

From the policy dashboard, select Statements and correspondence → View statements and correspondence. A list of your statements and correspondence, will appear. Select from the list and download to view.

Can I update beneficiaries for each of my policies?

We do not accept beneficiary nominations. Proceeds from claims will be paid to the policy owner or their estate.

My policy details don’t seem correct - what should I do?

Please chat directly with one of our consultants by clicking the chat icon at the bottom right of the page, a consultant will help answer any of your questions.

How can I give access to my partner or family for my Policy?

Yes, you can. You can complete the Authority to release information form and submit.

How can I submit a claim?

Am I eligible to claim?

If the condition you claim for is excluded from the policy, then we will not be able to fulfil your claim. This is why it helps to completely understand what conditions you’re claimed for under your policy when you’re setting it up.

To find out if you are eligible to claim against your policy please contact us, or you can contact your financial adviser.

I have a hypothetical query for a claim

We're here to help, to answer a hypothetical claim question, or if you have any questions relating to your insurance

- Contact us

- Contact your financial adviser

- Write to us at

Resolution Life Claims

PO Box 1692

Wellington 6140

New Zealand

I have a question about my claim

Once we’ve received your claim forms, a Claims Manager will contact you to discuss your claim and answer any questions you have. We feel it’s important that you always speak to the same person, so we will assign you a dedicated Claims Manager to help you throughout the process.

Where can I submit documents for my claim?

To lodge or submit additional claim documents, please send them to the following address:

Resolution Life Claims

PO Box 1692

Wellington 6140

New Zealand

Your next claim payment is due based on the terms and conditions of your policy and chosen payment cycle. You can find this information on the last payment advice you received or you can contact us.

What type of insurance do I have with Resolution Life?

If you are unsure on the policy type you have with Resolution Life, please refer to your latest policy schedule / annual statement which you can obtain from My Resolution Life. Please note that currently only Risk Protection Plans and Whole of Life/Endowment plans can be accessed on My Resolution Life.

If you have a financial adviser, they will be able to assist you further in understanding your policy or account.

How can I check if an adviser is registered on my account?

Your financial adviser contact details are generally located on your policy schedule / annual statement. If you have a financial adviser, they will be able to assist you further in understanding your policy or account.

Where can I find my current statement?

Your annual statement is generally sent to you after the financial year or on the anniversary date of your policy commencement. This statement contains important information such as your sum insured or withdrawal value of your policy. You can retrieve your latest policy schedule/annual statement and any previous statements on My Resolution Life. Once you have logged in, refer to the Statements & Correspondence section.

Please note that currently only Risk Protection Plans and Whole of Life/Endowment plans can be accessed on My Resolution Life.

What is a loan?

Loans can be taken against the value of your Resolution Life conventional policy also known as Whole of Life or Endowment policies. Variable interest rates are applied to the loan amount. If you would like further information on how you can apply for a loan, please contact us.

I want a loan on my policy

Generally, you can apply for a loan of up to 90% of your policy value. To apply for a loan against your Whole of Life or Endowment policy, please contact us.

How can I check if my payments are up to date?

We're here to help, to check to see if your payments are up to date, or if you have any questions about your insurance

- Contact us

- Contact your financial adviser

What is my waiting period?

The waiting period is the period of time that you must wait before your benefit can be paid. Benefits are not payable during the waiting period. Depending on what you chose when you set up your policy, your waiting period could be as short as 2 weeks or as long as 2 years.

You can find the waiting period applicable to your income protection policy by referring to your latest policy schedule / annual statement. If you do not have your policy schedule / annual statement, you can access this by logging into My Resolution Life. Once you have logged in, select statements and correspondence.

Please note that currently only Risk Protection Plans and Whole of Life/Endowment plans can be accessed on My Resolution Life.

What is my benefit period?

The benefit period is the period of duration that a benefit payment will be made, unless you return to work. This may vary depending on the type of benefit you have chosen.

You can find the benefit period applicable to your income protection policy by referring to your latest policy schedule / annual statement. If you do not have your policy schedule / annual statement, you can access this by logging into My Resolution Life. Once you have logged in, select statements and correspondence.

Please note that currently only Risk Protection Plans and Whole of Life/Endowment plans can be accessed on My Resolution Life.

What is my sum insured?

The sum insured is the amount of benefit you are covered for in the event of an accident, illness, or in the unfortunate circumstance that you pass. The type of benefit payable will depend on the type of policy you have with us. You can locate your latest sum insured by referring to your policy schedule/annual statement which you can obtain by logging into My Resolution Life. Once you have logged in, select statements and correspondence.

Please note that currently only Risk Protection Plans and Whole of Life/Endowment plans can be accessed on My Resolution Life.

What is my product name?

Your product name can be found on the policy document you would have received as part of your welcome pack when you took out your policy out.

We're here to help

If you have any questions about your insurance

- Contact us

- Contact your financial adviser

Where can I get my policy document?

Your policy document would have been included as part of your welcome pack which you would have received when you took your policy out.

We're here to help, if for some reason you can’t find your policy document or you have any questions about your insurance

- Contact us

- Contact your financial adviser

Where can I view my balance details

How can I increase my insurance?

You may be able to increase your insurance cover.

To discuss your options to increase your insurance cover you can contact your financial adviser or contact us.

How can I decrease my insurance?

You may be able to decrease your insurance cover.

To discuss your options to decrease your insurance cover you can contact your financial adviser or contact us.

How do I cancel my insurance?

You have a right to cancel your policy at any time. However, if you feel your policy no longer matches your insurance needs, or the cost of your policy is a concern, you may be able to adjust your policy so it aligns with your lifestyle and budget.

For options on how your insurance policy may be changed to meet your affordability and changing needs, you can contact your financial adviser or learn more here.

To discuss cancelling your policy, contact your financial adviser or call our Customer Solutions team directly on 0800 808 267 option 3.

How do I change my smoking status?

To be eligible to change your smoker status, you must not have smoked or used the following within the previous 12 months:

- smoked tobacco or any other substance

- used e-cigarettes, or

- used nicotine replacement products.

Note: You can apply for non-smoker rates after 12 months, however non-smoker rates may not be available to you if you’ve suffered from a smoking related medical condition.

You can alter your smoking status by completing the Non-smoker declaration form.

How can I remove the adviser from my account?

We're here to help, to change or remove your adviser, or to discuss changes to your adviser

- Contact us

- Contact your financial adviser

How do I amend the policy owner?

We understand your circumstances may change, and we welcome a conversation about your needs. So to remove or update the policy owner complete the transfer of ownership form which you can access here.

How can I decline or remove the Consumer Price Index (CPI) increase?

You can decline or remove the Consumer Price Index (CPI) increases from your insurance cover for the forthcoming policy anniversary year. You can contact us to discuss this matter with our Life Insurance Specialists. Alternatively, you can contact your financial adviser or scan a signed written request and email it to askus@resolutionlife.co.nz

Please note by declining the CPI this will mean your insurance cover could be eroded by the effects of inflation.

How can I remove additional benefits on my policy?

You may be able to remove benefits from your policy. You can contact us to discuss your options with our Life Insurance Specialists. Alternatively, you can contact your financial adviser to organise this on your behalf.

How can I request an insurance quote?

We're here to help, to obtain an insurance quote, or if you have any questions about your insurance

- Contact us

- Contact your financial adviser

What do I need to do if I want to change my name?

To update your name, please complete the change of personal details form which you can access here.

How do I amend my date of birth?

We're here to help, to update your date of birth, or if you have any questions about your insurance

- Contact us

- Contact your financial adviser

Please note a change of this nature may affect your current premiums and or sum insured.

How do I update my contact details?

To update your contact details, please log into My Resolution Life. Once you have logged in, select My profile → Contact details from the navigation menu.

How do I update my address?

To update your address, please log into My Resolution Life. Once you have logged in, select My profile → Address details from the navigation menu.

How can I update my communication preferences?

To update your communication preferences, please log into My Resolution Life. Once you have logged in, select My profile → Communication preferences from the navigation menu.

Can I pay by AMEX?

Paying by AMEX is not available for the policy you currently hold with Resolution Life. We can only accept Credit Cards from a Mastercard or Visa. For more information, please contact us. For more information out making payments, please click here.

How do I change my payment frequency?

To update your payment frequency, please log into My Resolution Life. Once you have logged in, select Payments and transactions → Payment arrangements from the navigation menu and complete the form. Your enquiry will then be submitted to Resolution Life to process within 5-7 business days.

Depending on your product, you can also make one-off payments. Please select Payments and transactions → Make a payment. If this option does not exist, please chat directly with one of our consultants by clicking the chat icon at the bottom right of the page.

How can I update my payment details?

There are 2 ways that you can update payment details, it depends on the product you have and what you want to update.

To update or set up a direct debit, you can do this by selecting Payments and transactions → Banking account details from the navigation menu

Any other payment related changes such as change of payment frequency or removal of a direct debit can be done by selecting My Profile → Payment arrangements from the navigation menu and complete the form. Your enquiry will then be submitted to Resolution Life to process within 5-7 business days.

Depending on your product, you can also make one-off payments. Please select Payments and transactions → Make a payment. If this option does not exist, please chat directly with one of our consultants by clicking the chat icon at the bottom right of the page.

How can I make a payment?

There are many different options for you to make your payment which include Internet Banking, Direct Debit or Credit card payment over the phone however some policies may not accept all payment options. For more information please click here.

I want to cancel my direct debit

To cancel your direct debit, please log into My Resolution Life. Once you have logged in, select Payments and transactions → Payment arrangements from the navigation menu and complete the form. Your enquiry will be then be submitted to Resolution Life to process within 5-7 business days.

Where can I get a withdrawal form?

We're here to help, to obtain a withdrawal form, or if you have any other questions.

- Contact us

- Contact your financial adviser

What is the purpose of the survey?

We’re always looking for ways to improve our services to you, our customer.

Hearing about your experiences with us will help us understand what is and isn’t working for you and how we can improve our services.

Why have I been asked to participate?

If you've received an email to participate in a feedback survey, it's because you’ve interacted with us.

We'd love to hear about your experience and understand what we could have done better.

What will happen with my feedback?

Your feedback is important to us, and it will be used to improve our services and deliver better experiences for our customers.

You may be contacted by one of our team members to provide us more information or to resolve an outstanding issue. Your feedback will also be used for training and coaching purposes.

Is my feedback anonymous?

Your privacy is important to us, and your responses whilst not anonymous will be kept confidential.

Your feedback will be shared with relevant team members to help deliver better customer experiences.

Resolution Life’s privacy policy covers how it handles, collects, uses and discloses your personal and sensitive information, including exchange with third parties located in New Zealand and overseas, and is available here or by contacting us. Resolution Life’s Privacy Policy also sets out your rights, including your right for access to and correction of your personal information.

Will my response be shared?

From time to time, we may share aggregated and anonymised survey responses with approved third parties.

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.