At Resolution Life, our priority is to support our customers and their families in their time of need.

We understand that knowing the type of cover you have and how much you’re covered for is crucial. You can learn more about the types of cover we offer and what else you may need to consider when reviewing your insurance.

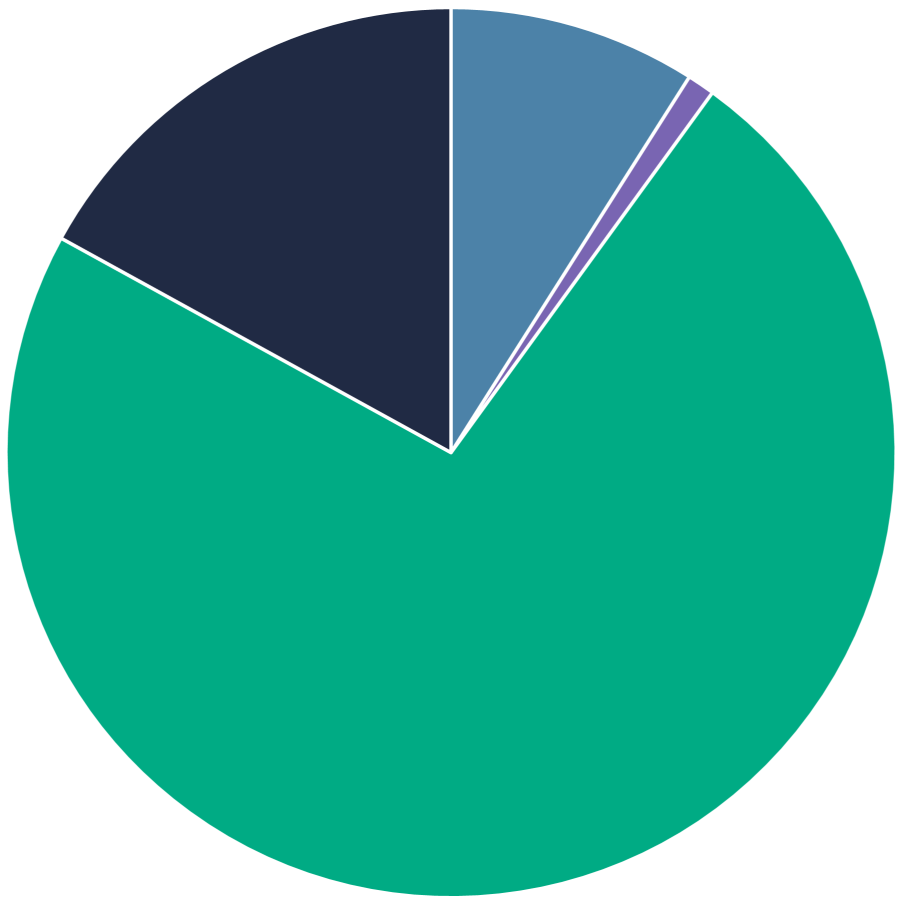

Summary of Resolution Life's overall insurance claims

Death and terminal illness (73%)

Income protection (17%)

Trauma (9%)

Total and permanent disablement (TPD) (1%)

In 2024, Resolution Life paid out $155m to over 2,141 customers, which equals $424,229 paid every day.

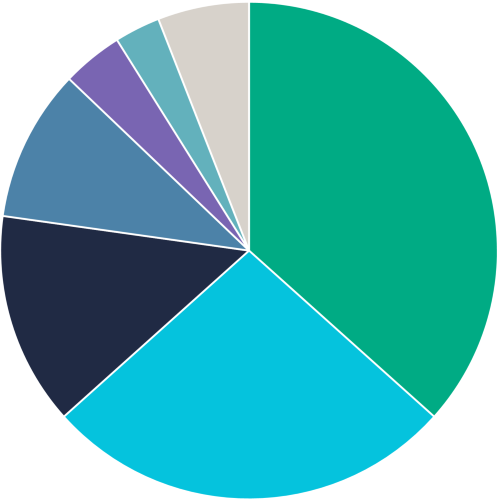

Summary of life insurance claims

Cancer (37%)

Heart attack, stroke and other circulatory diseases (26%)

Respiratory system disease (14%)

Nervous system disease (10%)

Accidents/injuries (4%)

Reproductive and urinary system disease (3%)

Other (6%)

Top 6 claim types by gender

In 2024, this is the percentage of males and females with claims in the top six categories

Male | Female | ||

| Heart attack, stroke and other circulatory diseases | 29% | Cancer - other | 32% |

| Cancer - other | 19% | Heart attack, stroke and other circulatory diseases | 14% |

| Respiratory system disease | 16% | Cancer - breast | 9% |

| Nervous system disease | 11% | Respiratory system disease | 9% |

| Cancer - bowel | 6% | Nervous system disease | 9% |

| Accidents/injuries | 4% | Cancer - bowel | 9% |

In 2024, the largest payout for life insurance claims for Resolution Life was ‘Cancer – other’ making up 28% of the total. This category includes cancers such as Leukemia and brain tumour.

In 2024, Resolution Life paid out $18m to over 196 customers, which equals $48,990 paid every day.

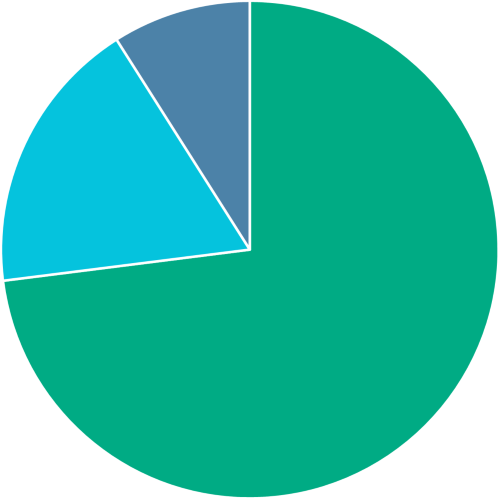

Summary of trauma claims

Cancer (73%)

Heart attack, stroke and other circulatory diseases (18%)

Nervous system disease (9%)

Top 5 claim types by gender

In 2024, this is the percentage of males and females with claims in the top five categories

Male | Female | ||

| Heart attack, stroke and other circulatory diseases | 27% | Cancer - other | 33% |

| Cancer - bowel | 20% | Cancer - breast | 32% |

| Cancer - other | 18% | Cancer - bowel | 12% |

| Cancer - prostate | 14% | Nervous system disease | 9% |

| Nervous system disease | 9% | Heart attack, stroke and other circulatory diseases | 5% |

In 2024, the largest payout for trauma insurance claims for Resolution Life was ‘Cancer-other’ making up 48% of the total. This category includes cancers such as malignant and pancreas.

In 2024, Resolution Life paid out $35m to over 773 customers, which equals $96,684 paid every day.

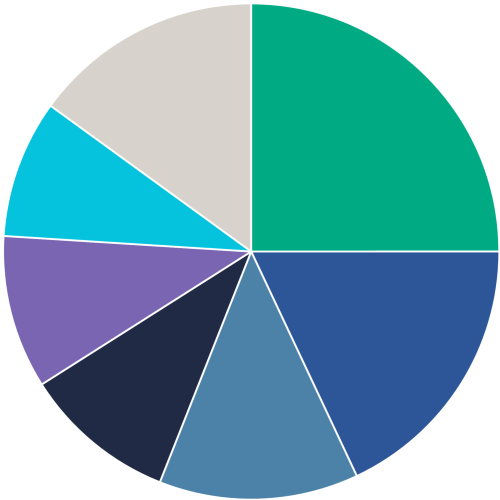

Summary of income protection claims

Cancer (25%)

Mental Health disorders (18%)

Nervous system disease (13%)

Musculoskeletal (10%)

Accidents/injuries (10%)

Heart attack, stroke and other circulatory diseases (9%)

Other (15%)

Top 6 claim types by gender

In 2024, this is the percentage of males and females with claims in the top six categories

Male | Female | ||

| Mental health disorders | 19% | Mental health disorders | 17% |

| Nervous system disease | 13% | Cancer - other | 13% |

| Cancer - other | 12% | Nervous system disease | 13% |

| Accidents/injuries | 12% | Cancer - breast | 12% |

| Heart attack, stroke and other circulatory diseases | 11% | Musculoskeletal | 8% |

| Musculoskeletal | 10% | Accidents/injuries | 6% |

In 2024, the largest payout for income protection claims for Resolution Life was ‘mental health disorders’ making up 18% of the total.

In 2023, 26% of the population in New Zealand experienced poor mental wellbeing4. This statistic is even more significant among women, with 31% reporting poor mental wellbeing compared to 22% of men5. These figures highlight the critical need for mental health support and resources to address this growing issue.

4Wellbeing statistics: 2023 | Stats NZ heading Mental wellbeing lower among women than men.

5Wellbeing statistics: 2023 | Stats NZ heading Mental wellbeing lower among women than men.

Important information

The content of this website is for information only, it does not contain any financial advice or other professional advice or make any recommendations about a financial product or service being right for you. The information provided by Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life), is of a general nature and does not take into account your objectives, financial situation or needs. Before taking any action, you should always seek financial advice or other professional advice relevant to your objectives, financial situation and needs, as well as consider the policy document for the product. Any guarantee offered in the product is only provided by Resolution Life.

Resolution Life does not make any representation or warranty as to the accuracy, reliability or completeness of material on this website nor accepts any liability or responsibility for any acts or decisions based on such information.

Resolution Life can be contacted at resolutionlife.co.nz/contact-us or by calling 0800 808 267.