It’s important to understand the type of cover you have and the amount you’re covered for, which can be viewed easily through My Resolution Life portal. The portal helps you to stay updated about your level of cover.

You may be eligible to make changes to your insurance cover with us. You can learn more about the types of cover available and what else you need to consider when reviewing your insurance.

Claims summary

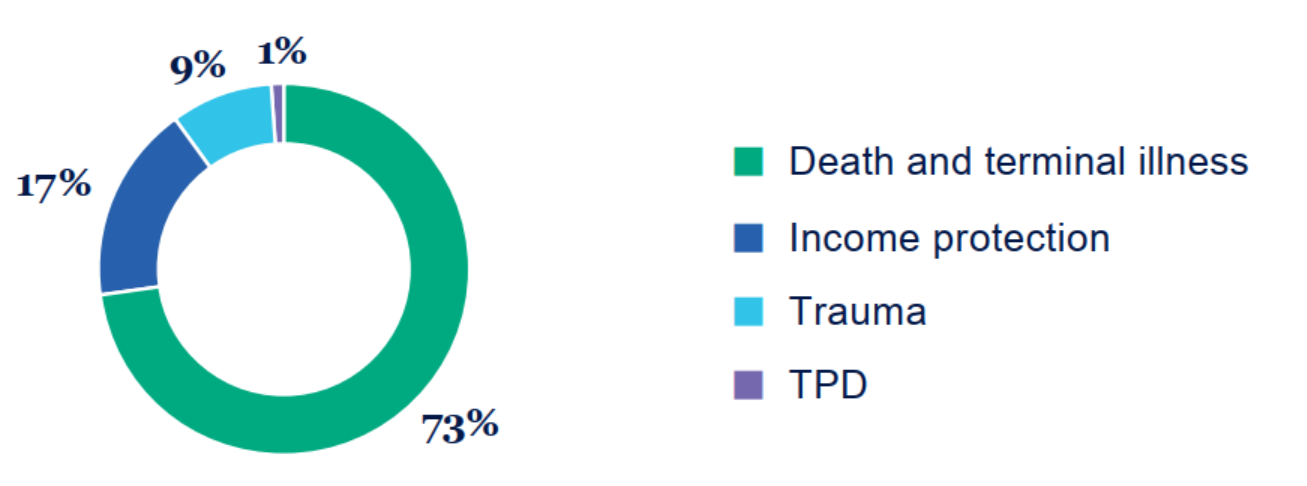

We manage a wide range of claims, reflecting the diversity of our products and our customers' claims. These cover a broad range of scenarios, meaning that we provide the necessary support when it’s needed the most for our customers.

Summary of Resolution Life’s insurance claims

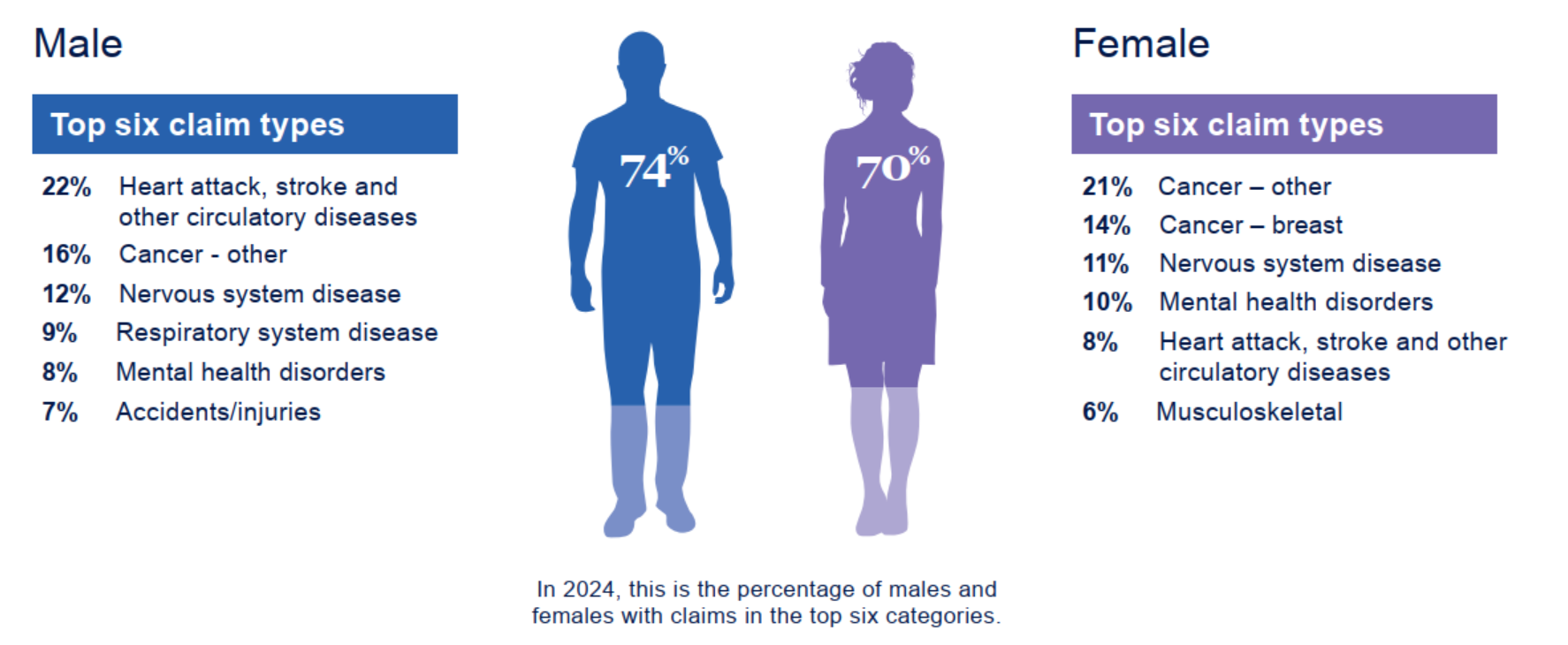

Overall insurance claims: males vs females

Our claim's philosophy

At Resolution Life, we’re committed to being there for our customers to help them during a difficult time in their life. Our approach is built on three core principles:

1. Support: We’re here to assist customers throughout their claims journey, providing the help and guidance needed.

2. Transparency: We believe in clear and open communication, ensuring customers understand every step of the claims process.

3. Caring: We approach each claim with empathy and compassion, making sure customers feel valued and supported.

To learn more about how much Resolution Life has paid for 2024, visit Resolution Life claims paid data 2024.

What you need to know

Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life). The content on this website is for information only. The information is of a general nature and does not constitute financial advice or other professional advice. Before taking any action, you should always seek financial advice or other professional advice relevant to your personal circumstances. While care has been taken to supply information on this website that is accurate, no entity or person gives any warranty of reliability or accuracy, or accepts any responsibility arising in any way including from any error or omission.